Amid little fanfare, gold has moved up above $2,100/oz. In fact, since the end of last week gold has continued to make new daily all-time closing highs:

Gold (Monthly)

The relatively strong performance of the gold price is in stark contrast to the lackluster performance of the gold mining sector. In fact, in the last six months we have witnessed what is arguably the largest ever underperformance by gold mining shares during a period of time in which the price of gold has risen more than 5%:

This dreadful sector performance has meant that the baby has been thrown out with the bathwater. Many junior gold miners have delivered positive results while achieving key milestones, yet their share prices are significantly lower than they were last summer.

If you think about this situation logically (rising gold price, positive news flow at the corporate level, etc.) it doesn’t make much sense, but this is the reality of the situation in March 2024. The flip side of historically poor sector-wide performance is that it delivers opportunities that wouldn’t exist otherwise.

One notable example of this phenomenon is Heliostar Metals (TSX-V:HSTR, OTC:HSTXF). In 2023, Heliostar aggressively advanced its fully-permitted Ana Paula Deposit to an updated resource estimate totaling 1.15 million ounces at an average grade of 5.5 grams/tonne gold. Heliostar acquired Ana Paula in early 2023 with a vision of drilling out an underground gold resource with a further aim moving expeditiously to a production decision within a couple years.

This is a sponsored post on behalf of Heliostar Metals Ltd.

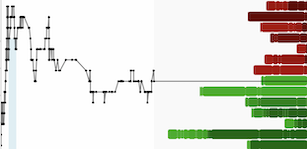

Meanwhile, Heliostar shares are down from $.35 in July 2023 to $.21 today:

HSTR.V (One Year)

In 2023, over the span of six months Heliostar delivered some of the best gold drill results in North America. These results achieved Heliostar’s objective of demonstrating that the core of the Ana Paula Deposit is higher-grade than the previous resource had delineated - 2023 drill results include:

- 63.0 meters averaging 10.4 g/t gold in hole AP-23-306 (high-grade panel)

- 14.6 meters averaging 33.0 g/t gold in hole AP-23-307 (lower zone in high-grade panel)

- 31.5 meters averaging 21.5 g/t gold in hole Hole AP-23-297 (high-grade panel)

- 104.1 meters averaging 6.14 g/t gold including 19.5 meters averaging 15.11 g/t gold

In total, the 2023 drilling at Ana Paula proved that the Ana Paula Deposit has strong gold grades and robust continuity. Relative to the previous resource estimate, Heliostar has demonstrated a 58% increase in measured and 30% increase in indicated gold grade. This increase in average grade occurs while keeping the cut-off grade at the same 2.5 g/t level.

In fact, a continuous zone containing more than 200,000 ounces of gold grading greater than 10 g/t gold is clearly evident within the latest resource update:

This high-grade zone within the measured resource of the High-Grade Panel can be targeted in the initial years of mining for a faster payback of initial capex.

On February 8th, 2024 Heliostar announced that the company is evaluating a test mining scenario for Ana Paula. Due to several unique advantages that Heliostar has at Ana Paula, the company is able to potentially commence test mining of a bulk sample:

- Heliostar holds an open pit mining permit for Ana Paula and test mining a bulk sample does not require a permit amendment.

- A 412 meter long decline is already in place (completed to 1/3rd of target length by previous operator).

- High-grade gold zone with consistent grades > 10 g/t gold allow for more than 20,000 ounces of gold to be extracted with a limited amount of waste rock.

- Test mining will help to reduce the cost of infill drilling and provide a platform for deeper resource growth drilling.

- The gold contained in the bulk sample can potentially fund the decline development.

Heliostar’s ongoing engineering study indicates that it will be necessary to extend the existing decline an additional 1,100 meters to the base of the High-Grade Panel:

According to the engineering study, achieving a production rate of four meters per day would allow for the completion of both tunnel and stope development within an eleven-month period, starting from the initiation of construction. This timeline ensures that test production could begin within 12 months from the start of construction.

Gold grades within the potential stope targets range between 7-10 grams per tonne. Various scenarios have demonstrated the potential to recover over 20,000 ounces of gold from the bulk sample.

The progression of the decline and the mining of a bulk sample are feasible under the current permits held by the company.

Heliostar is moving forward with a detailed engineering, mining, and metallurgical review concerning the bulk sample's potential. The company has engaged in discussions with prospective offtake partners and is currently having samples from the Ana Paula deposit evaluated for metallurgy, recovery, and payability by these potential partners. Preliminary financial models indicate that the value of the recovered gold would surpass the development costs. The company is considering self-funding and non-equity financial options for supporting the decline development, test mining process, and bulk sample collection.

When Heliostar acquired Ana Paula in early 2023, the Heliostar management team set a number of ambitious goals for themselves. These goals included a large drill program to upgrade the average grade of the resource with underground mining in mind, and delivering a resource update based on an underground mining method. They were able to achieve these objects on budget and in record time.

Heliostar CEO Charles Funk knows full well that time is money. In the mining industry this is especially true. Companies that spend years, or even decades, to advance their projects to construction inevitably end up diluting their shareholders into oblivion. It is with this in mind that Heliostar is committed to continuing to advance Ana Paula with urgency and shareholder capital at the forefront of their considerations.

Heliostar anticipates completing the detailed bulk sample review by the end of March and expeditiously moving forward with a multi-pronged approach that includes 10,000-15,000 meters of resource definition/expansion drilling and the completion of a PEA in 2024.

As the gold price continues its ascent, Heliostar Metals is uniquely positioned to deliver positive shareholder value through the economic mining of its fully permitted high-grade gold deposit in Mexico.

Disclosure: Author owns shares of Heliostar Metals at the time of publishing and may choose to buy or sell at any time without notice. Author has been compensated for marketing services by Heliostar Metals Ltd.

DISCLAIMER: The contents of this article have been reviewed and approved by Heliostar Metals Ltd. The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. The companies mentioned in this article are high-risk venture stocks and not suitable for most investors. Consult company’s SEDAR profiles for important risk disclosures.

The author of this article is not a registered investment advisor and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions. This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.