A very unusual thing is happening in financial markets today. I'm not talking about NVDA reaching a $2 trillion market cap, nor am I referring to the S&P 500 moving above 5,100. Heck, I'm not even referring to the incredible rally in Bitcoin over the last month, from ~40,000 to ~63,000. I'm talking about Friday's new record high daily/weekly closing price of gold in US dollar terms:

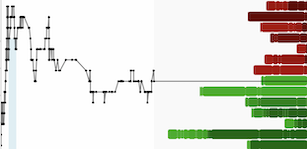

Gold (Daily)

Besides the powerful price/volume performance during Friday's trading session, what really stands out to me is how little attention gold is receiving. A scan of financial sites such as MarketWatch, CNBC, Bloomberg etc. returns zero articles/headlines on gold and Friday's all-time high close.

Meanwhile, futures open interest continues to tumble:

During past periods of strong uptrends in the gold price, such as 2019/2020, we have usually witnessed futures open interest rise along with increased speculative interest among futures traders.

Not this time.

We have also witnessed declining number of shares outstanding in the GLD exchange-traded fund (a proxy of interest in gold among North American investors):

The compelling fundamental case for gold is unchanged since my January presentation at Metals Investor Forum in Vancouver. However, perhaps the simplest thesis for owning gold is its bullish price action, and looming long-term chart pattern breakout, against a backdrop of muted investor interest:

Gold (Monthly)

In the event that gold does break-out above $2,100 in the coming weeks, I would expect silver to begin to outperform gold on a percentage basis. For example, a move from $2,095 to $2,200 is gold is a ~5% rally, whereas a move from $23.40 to $26.50 in silver is ~13%.

A confirmed breakout above the $23.50 resistance level in silver will target further upside to above $26/oz in the next few weeks:

Silver (Daily)

Some reversion to the mean in the gold/silver ratio from the current ~90 level to 75-80 would also be consistent with a more favorable market environment for precious metals mining stocks.

There are mounting signs that the Fed may be on the verge of announcing a 'tapering' of its QT (balance sheet reduction), and Fed Governor Waller's speech on Friday hinted at the potential for the resumption of QE. It's still too early to guess exactly what the Fed has in mind, but a resumption of Fed purchases of T-Bills at a time when the Treasury is committed to issuing more T-Bills than ever before sounds like we are on our way to back to QE sooner than later.

The recent price action in gold and bitcoin serve to confirm this suspicion.

DISCLAIMER: The work included in this post is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This video is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.