In this weekend's video, I spend some time discussing where we are in the '2023 Global Banking Crisis' and why this week is a critical one for markets. Perhaps much more interesting is the fact that gold is flashing a major BUY signal on various long term charts, including the gold/XLF ratio monthly chart:

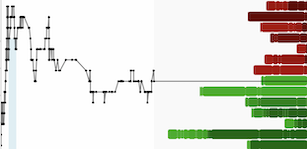

Gold/XLF (Monthly - 2002 to Present Day)

The gold/XLF ratio is on the verge of completing a 12-year bear market and it is just beginning to surge higher after staging a powerful failed breakdown last November.

This is quite possibly the most important chart out there right now across markets, and it is one that I believe few are paying any attention to. Last weekend's Barron's headline article pretty much sums it up; people are still looking to 'buy the dip' in the financials, and the vast majority of investors are highly underweight precious metals and miners.

GDX (Weekly)

Last week, the GDX printed a notable candlestick that included a gap above the previous week's high - a large full bodied green candlestick on heavy volume is a decidedly bullish phenomenon.

In the video linked above I discuss 5 gold/silver junior charts. I will add one more chart that has caught my attention in recent days, EMO.V:

EMO.V (Daily)

Emerita (TSX-V:EMO) has formed a well-constructed H&S bottom after bottoming in December of 2022. A weekly close above $1.00 would project a further advance to $1.30+. It's notable that Emerita has risen in 2023, while many of its copper junior peers have fallen. This is a divergence worth noting, especially considering the risk-off environment of the last several weeks.

Aurion Resources (TSX-V:AU) has been hugging up against an important resistance level near $.65 and feels like it could be on the verge of its next leg higher:

AU.V (Daily)

We are witnessing a very unusual situation, one in which gold is trading close to all-time highs while most precious metals juniors are well off their respective 52-week highs. Some stocks have even been making fresh 52-week lows during gold's recent climb.

Endurance Gold (TSX-V:EDG) is one of those stocks that has been hit hard in recent weeks. This sell-off has occurred during a period of light news flow for the company, however, that is about to change very soon as Endurance will be mobilizing its team for the commencement of 2023 exploration at the Reliance Project in the Bralorne Orogenic Gold Camp of B.C. in the next month.

Disclosure: Author owns shares of AU.V, EDG.V, and EMO.V at the time of publishing and may choose to buy or sell at any time without notice. Author has been compensated for marketing services by Aurion Resources Ltd. and Endurance Gold Corp.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.

.jpg)