It's been a rough year for the precious metals sector thus far, which isn't surprising with inflationary pressures and supply chain headwinds impacting costs, plus COVID-19 exclusions, and labor tightness impacting productivity. Some companies have continued to fire on all cylinders and made their own luck, like i-80 Gold (IAU.TSX/IAUX), which is one of the best performers sector-wide yet still undervalued. Unfortunately, some others have continuously disappointed, and Victoria Gold (VGCX.T/VITFF) is one clear example. Not only is the company set up to miss guidance by a mile for the second consecutive year, but it's waited for the eleventh hour (yet again) to deliver the unfortunate news about guidance, and when it was already quite clear the company had little hope of meeting its guidance mid-point.

(Source: Company Presentation)

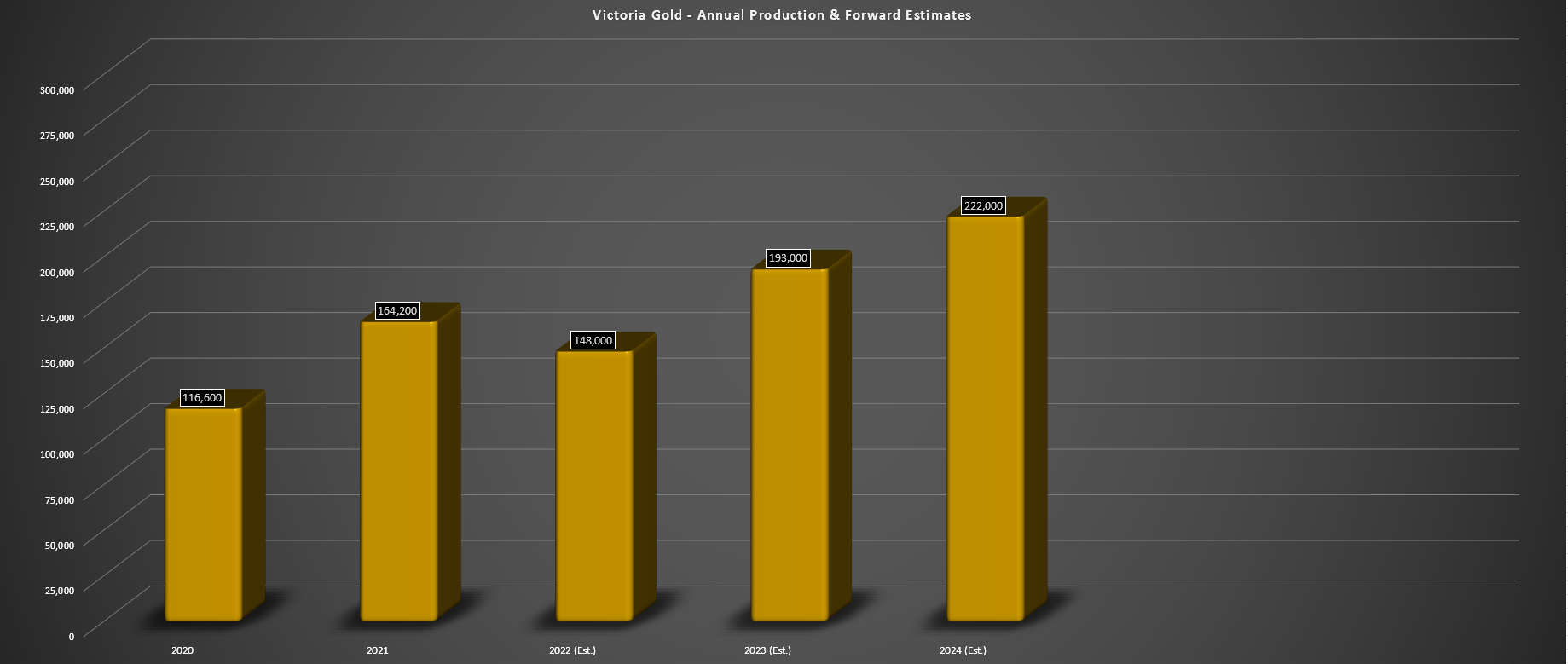

In Victoria's defense, the company was in a position to deliver in the lower range of its FY2022 guidance (165,000 to 190,000 ounces) before the overland conveyor belt failure and "exceptionally cold weather" in early 2022 impacted its Q1 operations. That said, this is not the first offense by Victoria Gold of over-promising and massively under-delivering, with it having guided a very ambitious 190,000 ounces at the mid-point in 2021, coming up over 13% short at ~164,200 ounces. In addition, the company made the bold claim that it was aiming to increase production to 250,000 ounces in 2023 by incorporating an intermediate scalping screen and year-round stacking to offset lower production in the coldest months of the year (moving from nine months of stacking to eleven months) with the addition of two 785 haul trucks and a loader. It will fail miserably on this goal as well.

This is because it's delayed the screen installation, and it's difficult to find construction crews. The result is that Victoria is now looking at a lower-cost alternative and it's discussed a 6-week shutdown vs. the planned four weeks (10.5 months of stacking), meaning it will be lucky to produce 210,000 ounces next year (slightly lower grades), setting itself up for a more than 15% miss vs. its soft guidance provided ten months ago. Given these constant missed promises and the fact that these haven't been near misses, I think it's much harder to simply give the company a pass on the missed guidance this year as it's done a terrible job managing investors' expectations. While this has certainly left a sour taste in the mouth of most investors, further weakness could provide an opportunity for new investors given that it's rare that a mine that is performing to plan (recoveries, grade reconciliation) in a Tier-1 jurisdiction is trading at such a deep discount to NPV (5%). Let's take a closer look below:

All figures are in United States Dollars unless otherwise noted.

Q3 Results

Victoria Gold's Q3 results were disappointing, to say the least, with quarterly production of just ~50,000 ounces of gold (down 10% year-over-year) and revenue of C$100.7 million vs. C$119.5 million in the year-ago period. Meanwhile, the company saw a cash outflow of C$8.7 million vs. free cash flow of C$32.2 million in the year-ago period, impacted by higher growth and sustaining capital and lower operating cash flow due to lower sales volumes, a weaker gold price, and weaker margins. This has placed Victoria in a position where it will not generate any free cash flow this year, which is not what investors were expecting in a $1,800/oz gold price environment with a company that guided for all-in sustaining costs [AISC] of $1,225/oz to $1,425/oz. Obviously, inflationary pressures are out of the company's control and can severely impact a high-volume operation like Eagle, and this has led to guidance misses for other producers as well. However, Victoria will see one of the most significant misses sector-wide, with AISC likely to come in near $1,520/oz, more than 6% above the top end of its previous guidance.

(Source: Company Filings, Author's Chart)

So, is there any good news?

Perversely, the company has done such a poor job of managing investors' expectations that it's a good thing because it would be hard to continue to disappoint them after two years of missed targets on costs and production and FY2023 soft guidance. This means that this is a case of the news being so bad it's actually good, with Victoria now in a position to lap very easy year-over-year comparisons and potentially having a tailwind from the gold price with the metal consolidating for two years and sentiment in the gutter. The result is that if Victoria can at least deliver on plans in 2023 and produce at least 195,000+ ounces, it should see a meaningful increase in revenue and free cash flow and also come out of the year with a much stronger balance sheet. When combined with the possibility of higher gold prices and an improvement in sentiment, I would expect this to lead to some mean reversion in the stock.

(Source: Bullish Sentiment for Gold, Daily Sentiment Index Data - July 2015 to October 2022, Author's Chart)

In addition, the company has reported some good news, including that it hired Timothy Fisch as Vice President and General Manager for the Eagle Gold Mine. Timothy Fisch has over 40 years of experience and began his career with Bethlehem Copper in 1978. Most recently, he was a member of the design team for Coeur's (CDE) Silvertip Expansion Project. Before this, he worked as General Manager at Red Chris and Mount Polley. While there are no guarantees, turnaround stories often begin with the appointment of new management to help sweep away any old issues, and this new appointment could lead to more consistent operations in the future. With luck, Eagle might finally be able to deliver 190,000+ ounces in 2023 and come in near the elusive 200,000-ounce mark.

The second piece of good news is that the company recently unveiled a maiden resource estimate at Raven with ~20.0 million tonnes at 1.7 grams per tonne of gold, translating to ~1.1 million ounces of resources. Raven lies 15 kilometers from Eagle, which means it can benefit from synergies in a future potential mining scenario, and its grades are well above Eagle's grades (1.7 vs. 0.65). Meanwhile, the Eagle deposit continues to show promise at depth and along strike, with drilling extending mineralization 500 meters west of the current pit and also extending mineralization more than 400 meters at depth. These positive developments have been ignored due to the constant disappointments in terms of meeting guidance, but they could start to be appreciated if sentiment can improve and once these ounces make it into a new mine plan (potential to significantly extend Eagle's mine life).

(Source: Company Filings, Author's Chart & Estimates)

Finally, it's hard for investors to get excited about a single-asset producer with $1,500/oz AISC, even if it's in a prolific mining jurisdiction (Yukon), but this looks set to change materially. This is because Victoria has had two years of elevated sustaining capital, which has put upward pressure on its AISC, making costs look much worse than they actually are. However, sustaining capital will likely average less than US$50 million over the next two years, down from over US$70 million in FY2021 and FY2022 (two-year average). Combined with a higher denominator (190,000+ ounces produced), Victoria is positioned to see a steep drop in unit costs barring another parabolic run in oil prices. So, while the Victoria of today leaves much to be desired, investors need to look 18 months into the future and visualize how the Victoria of H2-2024 looks with a 220,000+ ounce production profile and sub $1,175/oz all-in sustaining costs. In my view, that company commands a much higher multiple than it trades at today.

Valuation

Based on ~68 million fully diluted shares and a share price of US$5.70, Victoria Gold trades at a market cap of ~$382 million and an enterprise value of ~$550 million. I see this as a very reasonable valuation for a company with an estimated net asset value of ~$940 million, with Victoria now trading at just ~0.41x P/NAV. In fact, if Victoria were to remain below US$5.50 per share, I would not be surprised if larger producers took a close look at it from an acquisition standpoint, given that this is a Tier-1 jurisdiction asset capable of producing over 250,000 ounces per annum at sub $1,000/oz costs when running properly. In addition, the asset should easily have a 20+ year mine life when considering additional potential at depth and along strike, plus possible regional opportunities such as Raven (1.1 million ounces at 1.7 grams per tonne of gold).

Using a conservative multiple of 0.80x P/NAV to reflect Victoria's Tier-1 jurisdiction and relatively low operating costs (assuming a 220,000+ ounce production profile) offset by it being a single-asset producer, I see a fair value for the stock of $752 million or US$11.05 per share (18-month target price). This points to a 93% upside from current levels, but this assumes that Victoria can turn things around and see an expansion in its current multiple vs. the negative sentiment surrounding the stock currently. So, while Victoria may be a company that's harder to rely on and one that could remain an underperformer with much softer production in H1 2023 and not yet regaining investors' trust, I would argue that there is a limited downside from current levels. Besides, potential suitors couldn't care less if the company has done a poor job managing investors' expectations; they're focused on the asset and its long-term potential under their umbrella. Hence, I see two paths for a re-rating - a potential takeover offer if the stock stays at semi-depressed levels or simply having a decent year after two very tough years.

(Source: TC2000.com)

Moving to the technical picture, Victoria appears to have strong support at US$4.85 [C$6.55] and no significant resistance until US$7.95 [C$10.70]. From a current share price of US$5.75, this leaves the stock trading at a reward/risk ratio of 2.44 to 1.0, measured by its upside/downside from resistance/support vs. its current price. Typically, I prefer a minimum 5.0 to 1.0 reward/risk ratio to justify entering new positions, meaning that Victoria is not yet in a low-risk buy zone. However, if Victoria were to pull back below US$5.40 [C$7.30], it would drop into a low-risk buy zone and would become even more attractive from a valuation standpoint, sitting closer to 0.35x P/NAV. So, if I were looking to add exposure with a beaten-up production now offering a margin of safety, I would view further weakness as an opportunity to start an initial position in the stock.

It's easy to be negative on Victoria, and it's certainly a name that's easy to beat up on, given that it's done one of the poorest jobs sector-wide of meeting expectations the past two years among its 150,000-ounce plus producer peers. However, with some bad luck and two tough years in the rear-view mirror, the valuation has now become much more reasonable, and it would be difficult for the company to miss yet again when expectations are already so low due to past performance. Hence, I see Victoria as a decent turnaround story here for investors willing to be patient. Having said that, I continue to see more attractive opportunities elsewhere in the sector and prefer to buy on weakness, so I would only become interested below US$5.40 [C$7.30].

Disclosure: I am long AEM.T/AEM, IAU.T/IAUX

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.