While investors in the Gold Miners Index (GDX) have had a rollercoaster ride of a year with a 40% rally in April followed by a near 50% decline, it's been more like skydiving for investors the gold developers space, evidenced by massive drops with muted relief rallies. In fact, several names like Gold Mountain (GMTN.T), Newcore (NCAU.V), Novo Resources (NVO.T), and Bonterra (BTR.V) are down more than 70% from their highs and many have declined over 80% year-to-date. In some cases, this is not surprising due to the more difficult setup for juniors with weak balance sheets, an equity market that is not available to most without pricing shares well below market prices, and a lack of interest from majors/intermediates from an acquisition standpoint given that they'd rather leverage off existing infrastructure/expand current operations than buy and then build in most cases. The result is that this violent bear market has offered one of the most extreme value disconnects in years, but the caveat is that it's a high-risk, high-reward opportunity.

Given that there are many names on the sale rack among the producers that are paying investors to wait or at least generating steady free cash flow, stooping to own most juniors is a riskier bet, especially when we could have a catalyst-poor 2023 ahead if some doesn't raise money to drill or must considerably pare back their programs. That said, it is a market of stocks, not a stock market, and while there are dozens of stocks that are better left in the 'too risky' pile, there are 10-12 juniors with very solid stories that continue to move their projects along at a relatively brisk pace and have proper.ties that will ultimately host future mines given their superior economics and the fact that these companies have higher market cap to initial capex ratios that can support raising capital with debt to self-fund their projects. In the case of sub $100 million dollar companies, even strong economics may not be enough to put these projects into production given that the only hope of financing them is with an avalanche of share dilution, like Marathon (MOZ.T) graced its shareholders with rather than being proactive and raising more capital near multi-year highs.

One name that stands out as being among the best positioned in the junior space is Osisko Mining (OSK.T), and its recent Feasibility Study completed on its Windfall Project has confirmed the phenomenal economics, with highlights as follows. Let's take a closer look at the stock below:

- Average annual production: 306,000 ounces/Peak production = 374,000 ounces in Year 2

- All-in sustaining costs over the life of mine of $758/oz and a 10.4 year-mine life

- Average mined grade of 8.1 grams per tonne of gold, and a 3,400 tonnes per day throughput rate

- Upfront capex = US$607 million/After-Tax NPV (5%) at $1,750/oz gold = US$1.09 billion

- After-Tax NPV (5%) to Initial Capex ratio of 1.80 to 1.0/Average Annual After-Tax Free Cash Flow: $132 million

All figures are in United States Dollars unless otherwise noted.

Windfall Feasibility Study

Osisko released a Feasibility Study for its Windfall Project this week, showcasing an asset that is capable of producing ~306,000 ounces of gold per annum over a 10+ year mine life at industry-leading all-in-sustaining costs [AISC] of $758/oz. These costs if achieved would be nearly 45% below the estimated FY2026 industry average of $1,330/oz, and peak production is expected to come in at 374,000 ounces in Year 2. Overall, the Feasibility Study is a large deviation from a cost and capex standpoint from the 2021 Preliminary Economic Assessment [PEA], where AISC was estimated at $610/oz and upfront capital was estimated at $419 million (2022 FS: $607 million). While the increase in capital expenditures isn't surprising given the inflationary pressures we've seen sector-wide, the sharp rise in AISC was a little surprising, pushing Windfall from a project with few if any peers from a margin standpoint to one with a few peers among undeveloped assets help by juniors, including Hod Maden, Ikkari, Bellevue, Tocantinzinho, and Eskay Creek. However, on closer examination, there's a reason that the production profile came in a little lower than anticipated and costs came in above $750/oz, which are still phenomenal numbers to be clear.

(Source: Company Filings, Author's Chart & Estimates)

(Source: Company Filings, Author's Chart)

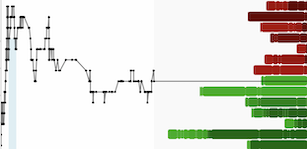

As noted in the updated Feasibility Study, mining dilution was 29% which is quite conservative, reducing the most recent resource's M&I grade of 11.4 grams per tonne of gold to 8.1 grams per tonne of gold in the Feasibility Study. This considerably impacts the average annual production and unit costs. Meanwhile, the three-pass capping strategy that caps high-grade composites from 6 grams to 200 grams per tonne of gold also dramatically affects the production profile/unit costs. This is especially true when bulk samples to date have shown a ~60% positive grade reconciliation, meaning that the Feasibility Study clearly does not do this world-class project justice. However, if we assume that dilution is too conservative and that we see some positive grade reconciliation (resulting in at least 9.0 grams per tonne grades going to the mill), this would result in a production profile closer to 340,000 ounces and all-in-sustaining costs below $700/oz, with every extra gram effectively adding ~37,000 ounces of extra gold outside the mine plan per annum. Meanwhile, if recoveries can be improved, this could add another few thousand ounces as well, with a 100 basis point improvement in recovery rates. Therefore, when looking at the above charts, I don't think it's a stretch to use the "Osisko Windfall - Pos. Grade Reconciliation" block vs. the base case "Osisko - Windfall" block on the chart to see how it stacks up vs. peers.

As the charts above show, Osisko already stands head and shoulders above nearly all of its peers from a production/cost standpoint, but this is even more true if we assume a production profile of ~340,000 ounces at $690/oz. In fact, the only real peer, in this case, would be Skeena's (SKE.T) Eskay Creek and the slightly higher-cost Mallina Project in Australia held by De Grey Mining (DEG.ASX) from a scale and margin standpoint. It's also worth noting that in addition to very impressive positive grade reconciliation from three bulk samples completed to date, over 1.6 million meters of drilling has been completed at Windfall by Osisko to contribute to this resource, suggesting that there is a much higher margin of safety in what's mined vs. the model than some rushed projects like Pure Gold's Madsen that was certainly a major disappointment for shareholders. So, I think Osisko is likely to be more similar to a Fosterville with regular upside grade surprises due to the conservatism in this mine plan, while Pure Gold was more similar to its neighbor Rubicon from a success standpoint.

(Source: Company Presentation)

Before moving on to the valuation, it's worth noting that this mine plan focuses on only resources within 1,200 meters from the surface, but mineralization has already been intersected at a depth of over 2.5 kilometers at Windfall and other major gold systems in Ontario/Quebec have been mined well past 2000 meters. Given Windfall's incredible mineral endowment in just the first ~1,200 meters, one could make a reasonable bet that this total resource (7.4 million ounces) has the potential to double by the end of the decade when it comes to resource additions at depth and along strike where the deposit remains open, as well as when adding in regional upside like the possibility of adding another 1 million ounces at the new Golden Bear discovery (~1 kilometer north of Windfall). So, for investors that were a little underwhelmed by the results of the Feasibility Study, I wouldn't lose too much sleep given that this is about as conservative as it gets, and the blue sky potential here is truly massive with Osisko forced to focus on Windfall given that every time it took a drill off Windfall Main and Lynx to plug holes in regional targets it was forced to bring them back due to another high-grade discovery that had to be followed up on. Therefore, today's 10.4-year-mine life could ultimately be a 20+ year mine life when all is said and done, yielding an NPV (5%) well over $1.70 billion, even without any positive grade reconciliation or pulling ounces forward with a higher throughput rate (shaft or satellite deposit like Golden Bear).

Valuation

Based on a conservative fully-diluted share count of 407 million shares and a share price of US$2.60, Osisko Mining has a market cap of ~$1,058 million and an enterprise value of ~$990 million. At first glance, this might suggest that the stock is fully valued, given that its After-Tax NPV (5%) at a $1,750/oz gold price comes in at $1.09 billion, leaving it trading at 0.97x P/NPV (5%). However, it's important to note that this After-Tax NPV (5%) only includes half of Windfall's contained resources, no upside from regional opportunities (Golden Bear, Fox, Fox West), no upside from likely resource growth at depth, no value for the recent Lynx 4 high-grade extension 625 meters down plunge, and no upside for the rest of its massive property. Given the fact that I expect considerable resource growth and ultimately an 11.0+ million-ounce resource base (or 7.0+ million ounces of reserves), I believe that the current mine plan significantly understates this asset's true potential and valuing the company solely on its current mine plan would be a mistake.

(Source: Company Presentation)

In fact, even if we apply a valuation of just $150/oz to inferred resources (~3.0 million ounces), this represents US$450 million in value outside of the current reserve base, and it still doesn't factor in any upside for regional opportunities, resource growth at depth, resource growth along strike, or the potential for positive grade reconciliation and less significant mining dilution (29%) than what is being modeled which could boost the After-Tax NPV (5%). In summary, after adding in $450 million in value for resources not in the mine plan and another $300 million upside at Windfall along strike/at depth, I see a fair value for Osisko Mining of $1,840 million. After subtracting $150 million in corporate G&A, its fair value comes in at $1,690 million or US$4.15 [C$5.40]. This points to a 60% upside from current levels, but it assumes no new major discoveries given that I have applied no value to the regional upside (nearby or across the property), and I have assigned no upside to improved recovery rates (optimized gravity circuit), positive grade reconciliation (extreme grade capping and bulk same outperformance), and no upside for less dilution than what's being modeled in the mine plan. To summarize, I see this price target as conservative.

So, what's next?

(Source: Osisko Historical Presentation, Recent Technical Report)

With a 60% upside to the base case scenario and significantly more upside in a more positive scenario, I continue to see Osisko Mining as attractively valued despite its sharp rally off its lows since September. In fact, I would not be surprised to see the stock head above US$3.70 [C$4.80] in the next year, and there's the possibility of an accelerated re-rating if a potential suitor makes a bid for the stock. Given that Windfall looks like the closest the sector has to another Fosterville in terms of projects in safe jurisdictions not owned by majors (~330,000 ounces at sub $700/oz with positive grade reconciliation or 450,000+ ounces per annum at sub $650/oz with a higher throughput rate and a shaft), I would not be surprised if this were a project that majors went after. The reason is that many majors are looking to claw back lost margins due to sticky inflationary pressures, and while some have projects in their portfolio with sub $1,000/oz costs and modest capex, few of them have projects capable of producing at less than $750/oz. To summarize, I see the stock as a Buy on dips and one of the better ways to get gold exposure in the sub $1.0 billion market cap space.

Disclosure: I am long OSK.T, SKE.T

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. This article is provided for informational purposes only, and is not intended to be investment advice of any kind, and the author is not sponsored by any company discussed in the article, nor has he ever been compensated by any company discussed in the article. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.