The immense success of names like Wheaton Precious Metals (WPM.TSX), Franco-Nevada (FNV.TSX), and Royal Gold (RGLD) has made the royalty/streaming sector quite popular among investors, given that it's a superior way to gain precious metals exposure and following the resumption of the bull market for gold in 2016 after what was a violent secular bear market; competition has certainly heated up in this segment of the space. In fact, we've seen multiple new companies move into the spotlight or announce their debuts, including Ely Gold Royalties (previously Ely Gold & Minerals), Elemental Royalties (ELE.V), Maverix Metals (MMX.TSX), Orogen Royalties (OGN.V), Gold Royalty Corporation (GROY), Empress Royalty (EMPR.V), Star Royalties (STRR.V), and others. Not surprisingly, this has led to some much overdue consolidation, with earlier entrants to the space Golden Valley and Abitibi swallowed by new-comer Gold Royalty Corporation, and Ely Gold Royalties acquired as well to create a larger company in a better position to grow its asset base from cash flows vs. debt and share dilution.

The most recent transactions in the space have included Royal Gold's acquisition of Great Bear Royalties (spin-out), Triple Flag and Maverix's merger in Q4 2022, and the attempted but failed takeover of Elemental Royalties, which led to the marriage of Elemental Royalties and Altus Strategies shortly after the Gold Royalty Corporation bid failed. In this update, we'll focus on the new company formed from this transaction, Elemental Altus, which sports a US$196 million fully-diluted market cap but a much larger portfolio with a solid pipeline. In fact, the new company boasts 11 producing royalties (well ahead of the majority of its junior royalty/streaming peers), with a portfolio underpinned by two cornerstone assets, a 0.42% NSR on the Caserones Copper Mine in Chile and a 2.0% NSR on the Karlawinda Gold Project in Western Australia. Let's take a closer look at Elemental Altus Royalties ("Elemental") below:

All figures are in United States Dollars unless otherwise noted.

A Decent Portfolio With Improved Diversification

While Elemental Royalties was consistently one of the stronger revenue generators over the past year in the junior royalty/streaming space once its Karlawinda deal came online, its two weak points were the fact that it didn't have the cash flow to support meaningful growth without taking on high-interest debt or selling equity, and it didn't have much of a pipeline. Additionally, it was highly concentrated, with Karlawinda contributing ~60% to revenue and its top two assets (Karlawinda and Wahgnion) making up nearly 80% of revenue. This was not ideal given that one reason to own royalty/streaming companies aside from their position as being inflation-resistant is their superior diversification vs. most producers (multiple assets contributing to revenue). For this reason, I noted in prior updates that the best play was to sell Elemental Royalties into the Gold Royalty Corporation offer given that Gold Royalty Corporation was arguably acting out of desperation, another suitor was unlikely to come over the top and out-bid given Elemental's highly concentrated portfolio with limited depth, and the stock was likely to see a sharp correction once the Gold Royalty Offer was abandoned.

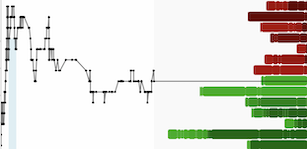

While the stock did plunge more than 40% from its Q1 2022 highs after the deal was rejected, we've seen a significant change in the investment thesis since then, with a merger announced between Altus Strategies and Elemental Royalties. This deal was supported by well over 90% of shareholders and for good reason, with this deal filling in gaps in both companies' portfolios to create a much stronger royalty/streaming company. Not only does the new company have improved access to capital at lower interest rates, but it generates significantly more cash flow, it is much more diversified on a NAV basis, and it has a stronger pipeline with a total of 56 royalty/streaming assets across multiple jurisdictions. The chart below shows how this has morphed the company, with Elemental previously having five paying royalties and this now increasing substantially despite only a partial quarter of contribution from Altus in Q3, including the addition of a major royalty on the Caserones Mine in Chile operated by JX Nippon.

(Source: Company Filings, Author's Chart)

In terms of optionality, the new company has royalty coverage over more than 7,500 square kilometers, with its highest concentration in Australia and Burkina Faso (two prolific regions for mineral endowment), with Morocco coming in at #3, a less popular region but one that has proven itself to be quite mining-friendly as evidenced by Aya Gold & Silver's (AYA.TSX) success in the region. Its development pipeline includes a few decent assets, but most are in the early stages and not yet close to generating meaningful revenue. In addition, the company has a decent exploration portfolio in very prospective regions, with multiple projects across Egypt, Cameroon, Ethiopia, and Mali. For those unfamiliar, the company has a strong technical team with a track record of successfully generating royalties in the past, with 22 royalties generated to date and the potential for another major royalty at Diba/Lakanfla as it continues to advance, as well as from its nearly 2,000 square-kilometer land package in Egypt. As we've seen with EMX Royalty, this can be a very lucrative strategy (royalty model with a royalty generator bonus), but it has often led to lower multiples for these companies, given that they don't have a "pure-play" royalty designation.

Obviously, if one believes in the strategy and the technical team, this undervaluation can create an opportunity, but re-rating in line with pure-play peers has been more difficult, and the suggestions that Elemental should trade anywhere close to the larger royalty/streaming peers from a valuation standpoint is a stretch.

(Source: Company Presentation)

Development Pipeline Could Use An Upgrade

While all of this is positive, the negatives worth noting are that while Elemental has a much larger and more diversified portfolio and leads several of its smaller peers regarding the number of paying assets, it does have one weakness that makes it hard to justify the stock commanding a multiple similar to its mid-cap peers. This is because only three of its paying assets (except for very small contributors like SKO/Mount Pleasant) are held by larger and well-capitalized operators, with its other paying assets (Mercedes, Bonikro, Ming, Amancaya, Ballarat, Kwale) held by much smaller operators with sub $250 million market caps. That does not mean that these assets can't succeed, but one of the strengths of companies like Osisko Gold Royalties (OR), Royal Gold, Franco-Nevada, and Wheaton is that they have multiple multi-billion dollar operators as partners, and several of these assets are their premier mines or top-3 assets, meaning they are spending aggressively to drill out and potentially expand these projects.

For Osisko's Gold Royalties, this includes Canadian Malartic, Mantos, Eleonore, Seabee, Island, Lamaque, Ermitano, and Lamaque. Meanwhile, the company's development portfolio includes Corvette (lithium), Cascabel (copper), Casino (copper/gold), Upper Beaver (gold), Spring Valley (gold), Marimaca (copper), Hermosa (base metals), Windfall (gold), WKP (gold), and several other projects. In Elemental's case, its most advanced development projects are held by small developers and not large operators, and even among its top-3 assets, one could argue that Wahgnion is the least impressive within Endeavour Mining's (EDV.TSX) portfolio, especially with Lafigue now in construction and a new major discovery at Tanda-Iguela. This doesn't mean that Endeavour will divest Wahgnion, but if the asset can't turn around in the next couple of years, this is certainly a possibility, and Endeavour has shown little hesitation to divesting assets given that it's focused on high-margin ounces and not its absolute production figure, evidenced by the sale of Karma, Agbaou, and Tabakoto, among others.

To summarize, although Elemental is reasonably valued at a market cap of ~$196 million or ~8.5x forward sales based on estimated FY2023 revenue of US$23 million, I think the suggestions by some that the company can command a mid-cap or large-cap multiple are quite bold, and while the stock may be cheap relative to the smallest royalty/streaming companies, I wouldn't call these companies cheap by any means. So, while this merger is a meaningful upgrade for Elemental Royalties 1.0, given that the previous company was un-investable due to being highly concentrated with a mediocre pipeline and elevated risk of share dilution, the new company may be investable following the merger, but it still doesn't come close to stacking up to the mid-cap peers/large-cap peers that some are comparing it to. In fact, many of its junior peers have more depth even if they lack meaningful cash flow, with royalties in the pipeline being advanced by strong operators. Hence, the key will be how Elemental builds its pipeline and if it does so conservatively by paying the right price for assets which could help it to outshine its junior peers and increase investor confidence in the team's ability to grow responsibly (discipline not to over-pay and to focus on great assets, and preferably not more cheap assets but at a reasonable price like Mercedes/Ming).

Let's dig into the valuation:

Valuation

Based on ~202 million fully diluted shares and a share price of US$0.97, Elemental trades at a market cap of US$196 million which is a very reasonable valuation for a company with 11 producing assets, nearly 60 total royalties, and two development assets, with 100% interest in one (Diba & Lakanfla) that is quite advanced with attractive economics. As the company notes in its most recent presentation and based on November figures, it has significantly higher revenue than its peers yet trades at a lower market cap, which would infer that Elemental is undervalued. However, I would argue that much of Elemental's peer group is overvalued relative to their mid-cap peers like Sandstorm (SSL.TSX) and Osisko Gold Royalties (OR.TSX), which trade at barely 1.0x NAV. So, while Elemental may be cheap relative to its peer group of junior royalty/streaming companies, I think it's more difficult to make a case for it being undervalued relative to mid-cap royalty/streamers, and it actually trades in line with EMX Royalties (EMX), which trades at ~5x sales based on estimates of ~$29 million in revenue next year and a market cap of US$250 million.

That said, Elemental is unique because it has a solid development project that it could divest through a sale or joint venture and generate a royalty on the project. Currently, the project boasts exceptional economics even if it is relatively small-scale with expected annual gold production of ~55,000 ounces at sub $700/oz all-in sustaining costs [AISC] and modest upfront capex of just $30 million. The result is an After-Tax NPV (8%) of ~$150 million at a conservative gold price of $1,750/oz, and even at a 0.30x P/NPV multiple to account for the project being early-stage and in a less favorable jurisdiction (Mali), this still translates to $45 million in value or US$0.22 per share under conservative assumptions. So, depending on how favorable a future deal is regarding the monetization of this asset, this could be a catalyst for a slight re-rating given that Elemental Altus doesn't appear to be getting much value for this asset currently.

Based on what I believe to be a fair forward revenue multiple of 9.0x given Elemental's attractive metals exposure (75% gold, 20% copper), and having ~50% of NAV from top-25 jurisdictions (Chile, Canada, Australia) offset by its mediocre diversification with 45% of NAV from its top two assets (Caserones and Karlawinda) and the fact that it's not entirely a "pure-play" royalty streamer, I see a fair value for Elemental of US$207 million. If we add in US$60 million in value for its development/exploration portfolio, this translates to a fair value of $267 million or US$1.32 per share., translating to a 36% upside from current levels. While this represents a solid upside case, I prefer only to start new positions if I have a minimum 40% discount to fair value regarding micro-cap names. This means that Elemental would need to dip below US$0.80 [C$1.07] to offer enough margin of safety on a risk-adjusted basis. So, while I think Elemental has moved from the bottom of the pack among juniors (heavy concentration and limited pipeline with no minimal ability to acquire new assets without dilution) to a more investable name, I don't see this as a low-risk buying opportunity just yet.

Summary

The amalgamation of Elemental Royalties and Altus has created a much stronger royalty/streaming company capable of funding larger deals from cash flow, which is a clear upgrade to the investment thesis. That said, I still don't see the stock as cheap enough yet from an investment standpoint, and with other mid-cap names with stronger partners and deeper pipelines also trading at attractive valuations, I continue to see more value elsewhere in the sector. So, while I think Elemental is a name to keep an eye on if we see a sharp pullback, I'm not rushing to add exposure at current prices.

Disclosure: I am long OR, EMX

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.