It's been a mixed Q2 Earnings Season for the precious metals sector, with sales up due to the record average realized gold price but margins mostly flat due to continued inflationary pressures and some one-time headwinds across the sector. Inflationary pressures have included higher steel costs (ground support) and higher consumables costs (cyanide), which have offset the benefit of lower energy prices in some jurisdictions. However, while most producers have been hit hard, it's the Mexican producers like Guanajuato Silver (GSVR.TSX/GSVRF) that have taken the biggest beating, with higher power costs, and we've seen companies like Endeavour Silver (EDR.TSX/EXK) note that costs will come in above their initial guidance range, placing a large question mark on Guanajuato Silver's ability to somehow deliver lower cash costs year-over-year which was implied in its April release despite the runaway Mexican Peso which should have given the company some pause on forecasting lower cash costs year-over-year. Let's take a look at the Q2 results below:

All figures are in United States Dollars unless otherwise noted. All-in sustaining cost margins [AISC margins] defined as all-in sustaining costs per silver-equivalent ounce vs. average realized silver price.

Production, Sales & Financial Results

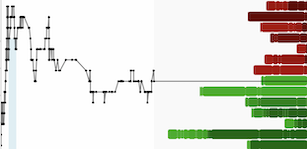

Guanajuato Silver produced ~941,400 silver-equivalent ounces [SEOs] in Q2, a marginal improvement from Q1 2023 levels and a significant increase year-over-year due to the benefit of last year's acquisitions. This increase in sales year-over-year with the benefit of a stronger gold and silver price ($24.33/oz silver, $1,988/oz gold) helped the company to increase revenue to ~$16.8 million (Q2 2022: ~$6.1 million), making it one of the highest-growth stories sector-wide. That said, it's not all about revenue in this sector, and I actually prefer companies that are more focused on margins than an absolute production figure, and we've seen the trouble that companies focused on solely growth can run into from the share price performance of Equinox (EQX.TSX/EQX) over the past three years. Unfortunately, in the profitability department, Guanajuato Silver put up disappointing results yet again, with mine operating losses increasing to ~$2.4 million vs. ~$1.7 million) in Q2 2022, and net losses increasing to ~$8.5 million vs. ~$3.5 million in the year-ago period. This is despite a record average realized gold price that has come down since Q2 2023 levels and despite the benefit of lower sustaining capital in the period. The result of the negative free cash flow in Q2 2023 was that working capital ended the period at [-] $17.8 million, and continues to sit deep in negative territory despite the recent financing that led to a 10% higher share count on a sequential basis (~490 million fully diluted shares currently) vs. ~441 million shares as of March 31st, 2023).

(Source: Company Filings, Author's Chart)

Costs & Margins

At the onset of 2023, investors may have believed that this would be a transformational year for Guanajuato Silver, with the company guiding for "cash costs per ounce to be slightly compared to 2022" (2022: $15.84/oz), while AISC was were to be "similar to 2022", with FY2022 AISC of $21.55/oz. To date, this hasn't been remotely the case, with year-to-date cash costs sitting at $17.39/oz, up ~10% year-over-year with no path to lower cash costs on a year-over-year basis. Meanwhile, an improvement in AISC year-over-year is also looking elusive, with AISC sitting at $22.15/oz year-to-date and needing to drop below $21.10/oz just to meet AISC from last year. Plus, even if this accomplished, this still fix the all-in cost issue, with the company's all-in costs sitting at ~$25.50/oz in Q2 (growth capital, share-based compensation, interest expense + AISC) or closer to $24.90/oz even excluding share-based compensation. This is not ideal from a margin standpoint, and the result of these higher costs despite lower sustaining capital is that Q2 all-in sustaining costs came in at $22.47/oz, up from the $21.83/oz reported in Q1 2023 despite the benefit of lower sustaining capital spend.

(Source: Company Filings, Author's Chart)

Digging into the operations on a mine-by-mine standpoint, Topia continued to be the highest-cost operation with AISC of $21.52/oz, cash costs of $19.19/oz and production costs per tonne of ~$271.70. These elevated costs were despite relatively modest sustaining capital spend of ~$0.65 million in the period, with the asset reporting an AISC margin of $2.75/oz on its ~279,000 SEOs produced. As for the CMC Complex (El Cubo), AISC came in at $20.96/oz, an improvement from Q1 2023 levels, but this was with the benefit of much lower sustaining capital in the period ($0.37 million vs. $0.70 million in Q1 2023). And it's worth noting that even if we don't adjust for further inflationary pressures, this sustaining capital figure is well below the life-of-mine average quarterly sustaining capital of ~$1.3 million provided in the 2023 PEA (~$31 million in sustaining capital / 24 quarters). Finally, at VMC, costs increased sequentially to $16.39/oz on an all-in sustaining cost basis, with this asset also benefiting from very modest sustaining capital of ~$0.41 million that helped to reduce AISC. So, with what should be higher AISC in H2, continued impact from the Mexican Peso which looks like it could average a higher price than H1 2023, I don't see any path to sub $20.00/oz AISC any time soon which is the unit cost needed to generate any meaningful free cash flow at a sub $27.00/oz silver price.

(Source: Company Technical Report)

Finally, looking at margins, they may have improved slightly to $1.86/oz, but it's not clear whether this trend will continue. This is because while silver has improved from its prior weeks lows, the average realized silver price is sitting closer to $23.60/oz quarter-to-date (below Q2 2023 levels), and the average realized gold price is also down meaningfully to $1,930/oz vs. the $1,988/oz realized price enjoyed in Q2 2023 by Guanajuato Silver. Hence, with what should be similar to higher sustaining capital, continued negative impact from the Mexican Peso and likely lower realized metals prices, I would expect another quarter of sub $2.50/oz AISC margins or sub 10%. And when it comes to producers with margins that are razor-thin, I see them as un-investable (especially if they have weak balance sheets) as one is entirely reliant on commodity prices cooperating to save the day and to avoid further share dilution to keep things afloat. Plus, while share dilution of this magnitude (10% sequentially) is bad enough, Guanajuato is no stranger to raising with warrants, with the last financing including a full warrant that could lead to an even further impact from a share dilution standpoint if exercised vs. cleaner common stock only deals without warrants offered by other developers/producers.

Valuation

Based on ~491 million fully diluted shares (year-end estimate) and a share price of US$0.24, Guanajuato Silver may look cheap at first glance at a market cap of ~$118 million. However, as discussed in a previous update, the company is actually more expensive than some of its peers like Avino (ASM.TSX/ASM) on a per ounce basis, with Avino trading at less than $0.50 per measured & indicated ounce with similar margins while Guanajuato Silver trades at ~$4.70/oz even if we assume it grows its M&I resource base to ~25 million SEOs (gold and silver ounces at a 75/1 gold/silver ratio). And from a financial standpoint, it's hard to argue for the stock being cheap, given that there is no free cash flow multiple to assign as no free cash flow is being generated. This is because the company is reporting all-in costs of ~$24.90/oz (includes growth capital, interest expense) even in a period of lower sustaining capital spend, rendering it incapable of generating consistent and meaningful free cash flow at a sub $27.00/oz silver price. Plus, I continue to see share dilution being a risk here due to the weak balance sheet and lack of free cash flow generation, suggesting that while GSVR's market cap may increase, this may not help investors as much as they expect given that the market cap increase will likely be offset by a high probability of further share dilution, impeding share price growth.

Summary

While Guanjuato Silver may have succeeded in growing production in Q2, this was about the only win, with its fully-diluted share count up over 10% sequentially (Q2 vs. Q1), its all-in costs continuing to sit well above the average realized silver price, and the company continuing to report net losses and bleeding cash with no clear end in sight to this dilution. And while more disciplined producers like Endeavour Mining (EDV.TSX/EDVMF) have been willing to shed marginal assets to optimize their portfolio, this is not the Guanajuato Silver model to date, which has seen the company more than double production but with a ~65% increase in operating costs per tonne. The result of these high-cost operations and the rising Peso (which has strengthened further since the Q2 average) is that Guanajuato Silver continues to provide negative leverage to precious metals prices with it having to finance itself with share dilution at depressed prices vs. other producers like Pan American Silver (PPAAS/PAAS.TSX) that are returning capital to shareholders with attractive dividend yields.

If there was a clear end in sight to this share dilutionand a path to sub $20.00/oz all-in cost margins, there might be an investment thesis here. However, as stated in past updates, the negative working capital combined with razor thin AISC margins (and negative all-in cost margins) meant that Guanajuato Silver will need a $27.00/oz+ silver-equivalent price to generate any meaningful free cash flow, and until this was the case, trying to figure out the valuation was near impossible as the share count would continue to rise and be a moving target. Plus, VMC (lowest-cost complex) could have a softer quarter with less contribution from San Ignacio, the Peso has strengthened further from Q2 levels which will put continued pressure on costs, and this means that there's a high probability that we'll see further share dilution in the next 12 months. To summarize, I continue to see Guanajuato Silver as un-investable despite its recent correction, and I see dozens of better ways to allocate one's capital elsewhere in the sector.

Disclosure: I am long PAAS/PAAS.TSX

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.