It's been an exciting year thus far for the Gold Miners Index (GDX), with the ETF up 12% year-to-date, outperforming the major market averages for a second consecutive year. However, because of anxiety about a share sale by Equinox (EQX) to help fund Greenstone development (which ended up coming to fruition) and a tough market for gold developers which continue to diverge from high-flying producers like Torex (TXG.TSX), Dundee PM (DPM.TSX) and Alamos Gold (AGI.TSX), i-80 saw its share price abruptly decline by ~35% after massive outperformance in 2021 and 2022 vs. peers. Understandably, this frustrated some investors that may not be used to the volatility in the sector and the fact that technicals can detach from the underlying fundamentals over short-term periods. That said, while drawdowns can be frustrating, I've never seen much value in obsessing over share price performance over the short-term, especially when it comes to leading growth stories in the sector like i-80 Gold has the capability of becoming.

In fact, if one missed the forest for the trees and panicked during each 20%-35% correction for Kirkland Lake Gold (KL.TSX), they would have left over 1000% on the table from a return standpoint, given that corrections are normal even in the best stories. Rather than get annoyed with corrections, investors should embrace them as long as they understand a story (and position size accordingly), given that stocks need to pullback to fill up the proverbial tank to continue on an upward trajectory and deep pullbacks can be thought of as rest stops along the way to an ultimate destination of much higher prices (assuming the fundamentals are supportive). Plus, investors patient enough to sit through a full multi-year cycle are the ones that benefit the most, given that stocks tend to trend in a gradual manner in the early innings of their cycle, but the pace of this trend higher often speeds up in the latter innings, as we saw with American Barrick (1000%+ move from March 1985 to September 1988 before a 2-year consolidation period). Hence, the most significant gains are made by staying along for the ride and adding on pullbacks.

(Source: Company Website)

It is important to note that I see i-80 Gold as the exception, not the rule to the above point among gold developers/junior producers. Most gold developers and junior producers do not trend from lower left to upper right and should not be accumulated, and most are trading vehicles only and not worth owning for an investment. In fact, I would argue that 98% of gold developers are not investable and therefore I focus on established producers. That said, I see i-80 Gold as a unique opportunity, given that I see a path to proving up a 19 - 20.0 million ounce gold-equivalent resource base in Nevada by year-end 2025 - inferred + measured & indicated resources).

(Source: TC2000.com)

(Source: StockCharts.com)

So, how does this relate to i-80 Gold?

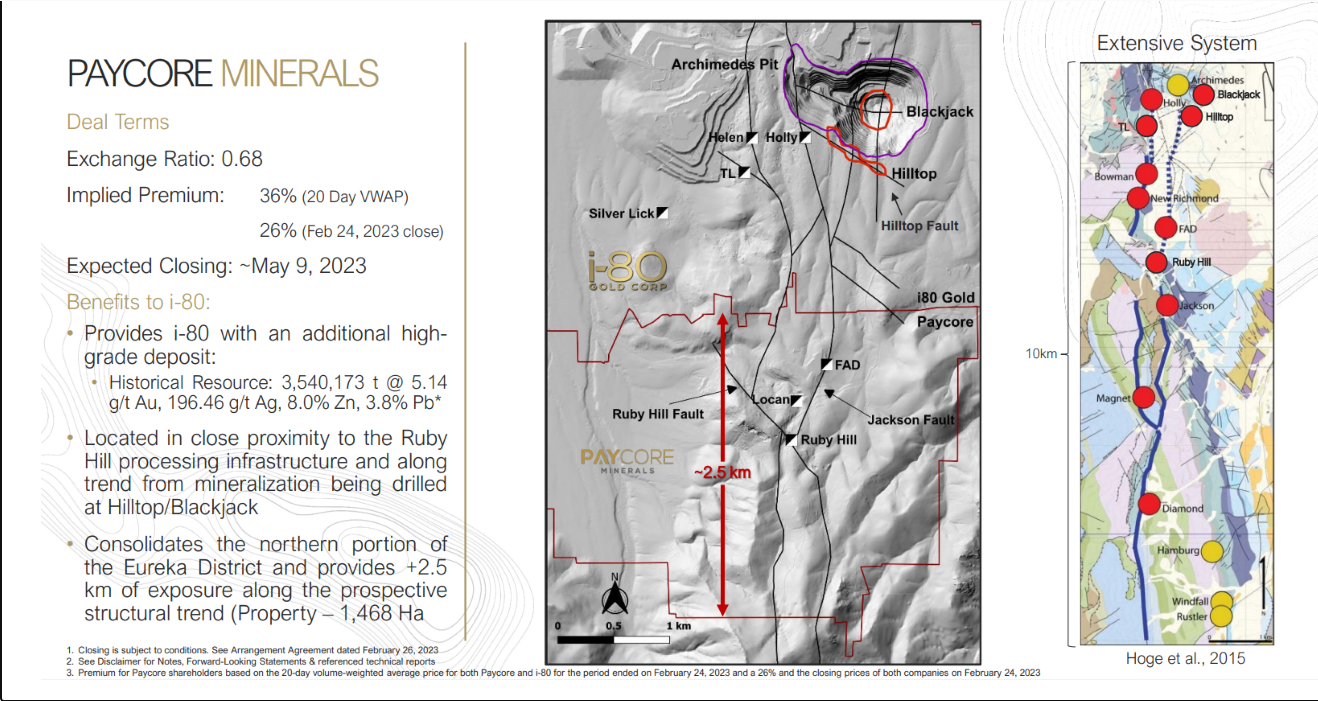

While i-80 Gold is no Kirkland Lake Gold and no American Barrick, the company has unique attributes similar to these companies and it's arguably the top growth story in the sector with the potential to increase production from ~30,000 ounces in FY2023 to ~220,000 gold-equivalent ounces [GEOs] in 2026 within top-ranked mining jurisdictions and 400,000+ ounces long-term (~1200% production growth from FY2023 levels). The other similar attribute is that the company has industry-leading grades at several of its future potential mines (Ruby Deeps, Granite Creek Underground, Hilltop/Blackjack, McCoy-Cove) and it is generating considerable shareholder value through the drill-bit and by picking up properties for an attractive price and adding value to them by hunting down mineralization others either missed or were less focused on, such as the polymetallic potential at Ruby Hill, and its new South Pacific Zone discovery at Granite Creek Underground. The most recent development is that the company has announced a deal to acquire its southern neighbor, Paycore, which I see as a very fair deal and positive for Paycore shareholders given that it launches Paycore from the earlier innings of the Lassonde Curve much closer to production as it benefits from i-80's strong treasury, existing permits, and a CIL Plant that can be refurbished to a flotation plant.

(Source: Company Filings, Author's Chart)

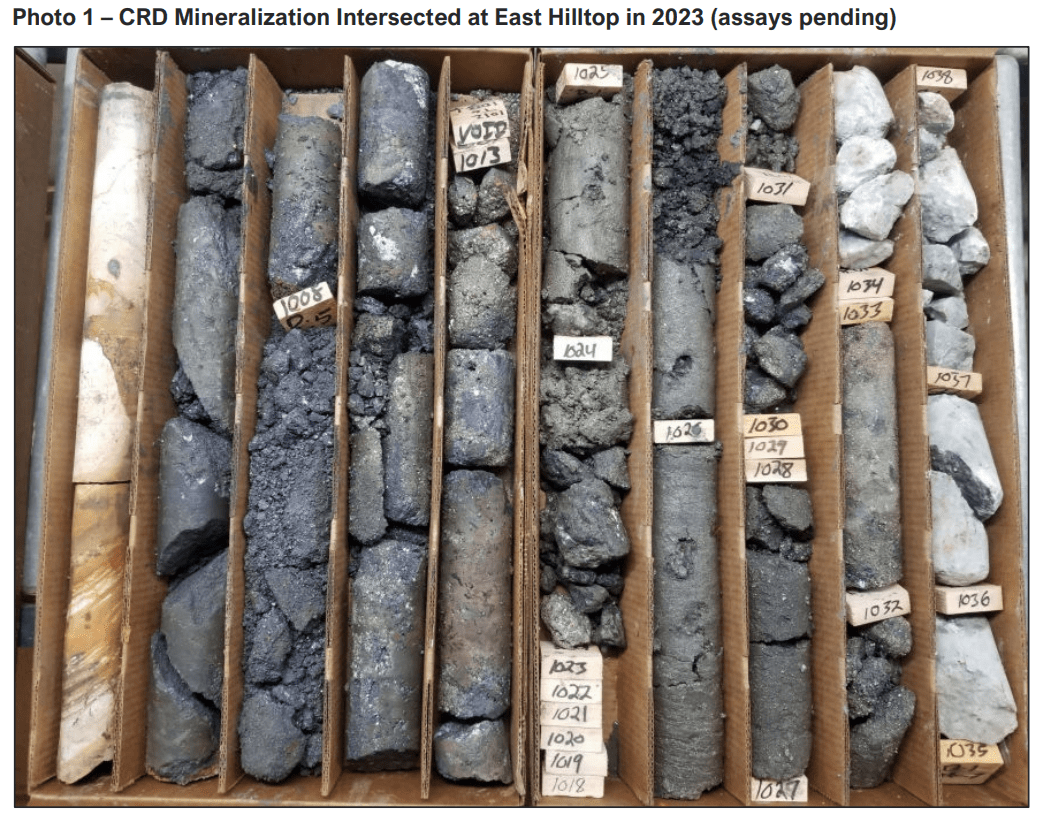

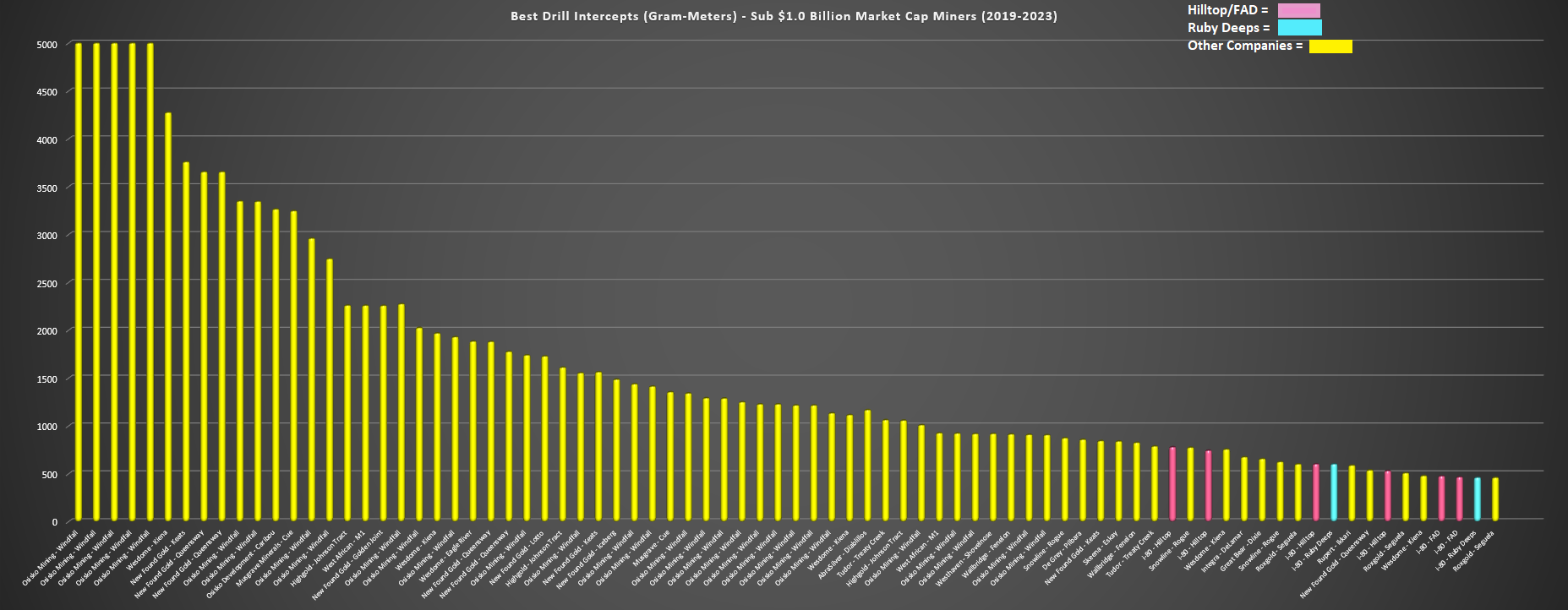

Looking at the chart above, we can get a glimpse of this exploration success, with the top-90 drill results at gold projects ranked in order from 2019 to 2023 among sub $1.0 billion market cap companies. All of the top drill results are shown in yellow on a gram-meter basis, with Hilltop/FAD results in pink, and Ruby Deeps results in blue. While i-80 may look like it's at the back of the pack, it's important to note that 30 of these drill results belong to just one company (Osisko Mining - OSK.TSX), so i-80 actually owns 8 of the top 60 drill results sector-wide among juniors or ~13%, which is quite incredible given that it only started really drilling these properties a year ago. However, with the addition of its southern neighbor (assuming deal closes), this could add critical mass to the polymetallic opportunity with an additional 2.5 kilometers of strike past the i-80 Gold southern border which butts up against the Paycore ground. This acquisition is a big deal because it could mean ultimately contemplating a larger footprint and throughput rate for the polymetallic opportunity which continues to look like it's taking priority over the gold hub & spoke model from a sequencing standpoint (Ruby Deeps, McCoy Cove, Granite Creek Underground feeding Lone Tree Autoclave) due to it being higher margin and lower capex.

(Source: Company Website)

Even if we use an estimate of $85 million for the floatation plant conversion from the current CIL Plant and $60 million in mine development, upfront capex would be ~$145 million vs. ~$280 million for the autoclave refurbishment (conservative estimate) that doesn't factor in additional mine development at McCoy Cove and Granite Creek. Importantly, i-80 has a flotation circuit at Lone Tree and it's possible it could save money by using some parts from this site if it were to look to expand the floatation plant at Ruby Hill. I expect it could be expanded to 2,500 tons per day (vs. 750 tons at the start of production) for less than $70 million in Year 4 placing total capex for the polymetallic opportunity at ~$210 million ($145 million upfront, with an expansion). This is an incredible return for a project that could ultimately churn out $100 million in free cash flow at spot prices, and upwards of $150 million if it was scaled up to 2,500 tons per day. Let's take a look below:

So, what has changed, and what's the opportunity with Paycore?

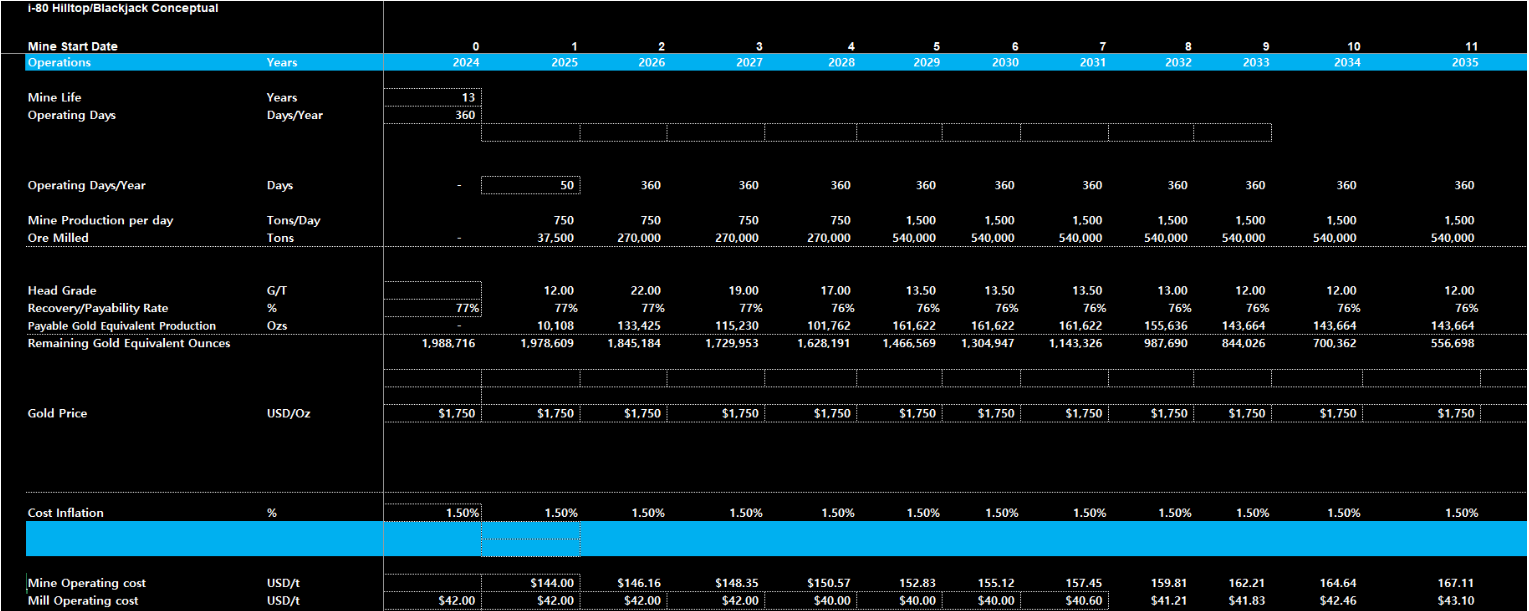

It's important to note that we don't have confirmed resources yet, so this is all preliminary for Hilltop/Blackjack and I'm having to work with assumptions in technical reports for other miners, preliminary numbers from PEAs and trying to adjust for inflation where needed. However, as noted, I saw the potential for an NPV (8% discount rate) of $400 million to $600 million depending on different grade, capex and cost assumptions, and went with the lower end of this range to be conservative. I have tightened up cost assumptions a little and used a $1,750/oz gold-equivalent price to be conservative (this will be a blend of zinc, lead, silver, and gold producing two concentrates [lead/silver and zinc] at Hilltop/Blackjack/Paycore's FAD Property) if it goes into production.

I have used an 8% discount rate for an industry standard of 5% given that this is very preliminary and base metals are often valued at 8% vs. the 5% standard for precious metals, and a significant portion of revenue here would be from base metals.

My assumptions that went into this were starting at 750 tons per day, an average gold-equivalent grade of ~14.0 grams per ton (~19 grams per ton in first three full years while mining the higher-grade Upper Hilltop Zone), mining costs of ~$144/ton and processing costs of ~$42.00/ton with cost inflation baked into these numbers to be more conservative with mining costs increasing each year. Finally, I would expect processing costs to improve due to economies of scale (following Year 3), so processing costs are estimated at $36.00/ton to $42.00/ton. I have shown a table highlighting some of these assumptions and the potential production profile below for a 13 year mine life (production of ~2.0 million GEOs) with an NPV (8%) of $600 million. As shown, I have assumed an expansion in Year 4 to 1,500 tons per day starting in 2029.

(Source: Company Filings, Author's Estimates)

As we can see, gold-equivalent ounce production would come in at 100,000 to 130,000 GEOs to start at sub $850/oz all-in sustaining costs, and then increase in the expansion years to ~140,000 to ~160,000 GEOs and should maintain sub $900/oz all-in sustaining costs. The higher throughput rate will be partially offset by my assumption of lower grades in the 12.0-13.5 gram per ton gold-equivalent range (2029-2037). It's important to note that these grades (12.0 - 13.5 grams per ton gold-equivalent) are well below what we're seeing from drill results at Hilltop, but I am blending slightly lower grade Blackjack material and I am baking in mining dilution and given that we're still early in the exploration/development stage regarding Hilltop/Blackjack and the overall Hilltop Corridor, I prefer to be conservative on grades.

However, with the acquisition of Paycore (and addition of key ground to the south) which could make i-80 more confident in the ultimate size of the opportunity being 10+ million tons or ~4.1+ million GEOs in resources (65% conversion gives ~2.7 million GEOs of reserves) at 14 grams per ton gold-equivalent, I would not be shocked to see an expansion to 2,500 tons per days by Year 4 (2029) which would dramatically change the economics from my previous outlook of 750 tons per day to start at the onset, increasing to 1,500 tons per day in Year 4. For what it's worth, I think the two properties could host well over 12 million tons of resources and I think my 14 gram per ton gold-equivalent assumption may end up being too low. Still, it's better to err on the side of caution since we've seen less than 50 holes drilled at the two properties to date, even if the results have been very encouraging with multiple 450+ gram-meter intercepts and a highlight intercept of ~780 grams per ton gold-equivalent, which is one of the top 65 holes drilled sector-wide on a gram-meter basis among sub $1.0 billion market cap names since Q4 2019.

Paycore alone has a ~3.5 million ton historical resource at FAD (~14.0 grams per ton gold-equivalent) which doesn't factor in step-out drilling success or any new discoveries on the property. Even incorporating additional mining dilution (if developed), being a little more conservative on grades, and assuming no resource upside, this represents a resource of ~1.1 million gold-equivalent ounces at industry-leading grades (~11.0 grams per ton gold). However, to date, Paycore's drilling has validated these grades with multiple intercepts above 15.0 grams per ton gold-equivalent.

If we look at updated economics by switching the 1,500 ton per day expansion to 2,500 tons per day in Year 4, we see that the production profile improves to ~240,000 to ~270,000 GEOs post-expansion at sub $900/oz all-in sustaining costs (preliminary estimates), given the benefit of economies of scale, with average annual free cash flow of ~$150.0 million and an NPV (8%) of $1.0+ billion. This figure covers i-80's current market cap, and I would argue I've been conservative on mining costs given that I'm using underground mining costs well above the average across Nevada ($144.00/ton -> $170.00/ton over the mine life), and I have also have been conservative on processing costs with the Scoping Study by i-80 assuming processing costs of $38/ton on a small scale, and I've used $42/ton pre-expansion with $36/ton post-expansion (lower because of economies of scale). I also think that I'm being very conservative on the metals price ($1,750/oz gold-equivalent) but prefer to be conservative because of the multiple metals in the mix (zinc, silver, gold, lead) and grades are the big wild card, but I think I could end up being conservative here too.

(Source: Company Filings, Author's Estimates)

The takeaway is that even with ~350 million fully diluted shares and a share price of US$2.40, i-80 is trading only slightly above the base case (750 TPD to start, then expansion to 1,500 TPD in Year 4) using an 8% discount rate of ~$600 million for Hilltop/Blackjack, and actually below the expansion case (750 TPD to 2,500 TPD) using an 8% discount rate for Hilltop/Blackjack/FAD ($1.0+ billion). This excludes all its other properties, it excludes the potential for a high-grade porphyry at depth (bonus upside which I'm not relying on), and it excludes any major new high-grade CRD discoveries that could be pulled forward in the mine life just behind the highest-grade opportunity (Upper Hilltop). Finally, it assumes Upper Hilltop at ~20.0 grams per ton gold-equivalent is the best it gets before considerable moderation in grades down to 12.0 - 13.5 grams per ton gold-equivalent. And this all assumes that the average realized gold price on a gold-equivalent basis is just $1,750/oz between 2026-2039. With gold sitting above $1,900/oz today and having the potential to make up a considerable amount of credits given the Carlin overprint on top of this growing CRD system, I would argue that this is also conservative.

Based on all of this, I see a fair value for i-80 Gold of US$4.73 (97% upside) to its 2-year target price using a 1.1x P/NAV multiple. Notably, potential growth stories of this quality with industry-leading grades in safe jurisdictions like Kirkland Lake Gold and American Barrick traded well above 1.50x P/NAV in their best years (2016-2019). I'm not relying on that and while this is a special story, Hilltop is no Fosterville and it's no Goldstrike. Still, I don't think 1.1x P/NAV is an unreasonable multiple, and if one wanted to be more conservative, they could remove any upside from Paycore Ground/Exploration upside and remove Mineral Point since it's a longer-dated optionality play, but even under these assumptions, fair value is still north of US$4.00. So, with over $100 million in cash following its latest financing, up to $100 million with its accordion feature (Orion 2021 deal) and ~$50 million from potential warrant exercise, I see i-80 well positioned to drill aggressively, start major underground development next year at Ruby Hill, and potentially start producing from a float plant by December 2025 while in full production at Granite Creek (under its toll-treatment arrangement), with the potential for an autoclave restart in H2 2027 to be conservative on timelines. Importantly, share dilution should be modest in the future, with cash flow from Granite Creek Underground and Upper Hilltop able to fund the autoclave refurbishment.

(Source: Company Filings, Author's Estimates & Table)

Putting it all together, this is a company capable of growing from ~30,000 ounces in 2023 (residual leaching + ramp up at Granite Creek Underground) to 400,000+ ounces later this decade, with an upper level of 500,000 ounces with a Hilltop/Blackjack expansion (240,000+ GEOs) + Hub/Spoke gold model (240,000+ ounces) + oxides. A company with that profile in Nevada easily trades above a US$3.0 billion market cap, which is more than triple the current fully diluted market cap (~$840 million) and that assumes Granite Creek Open Pit nor Mineral Point ever go into production, with both being 180,000 ounce per annum operations as well (assumption of 50,000 tons per day at Mineral Point). Given the medium-term upside (2-year target price of US$4.70) and long-term upside to north of US$8.00 (assuming ~375 million fully diluted shares long-term) if i-80 executes successfully, i-80 continues to be my favorite idea among all small caps and mid caps.

Regarding catalysts, I would expect the share price performance to improve with a steady stream of news from April through to year-end as drill results start coming in and we see updated and maiden resource estimates / studies completed, such as Ruby Deeps (resource upgrade), Granite Creek (reserves and Feasibility Study), South Pacific Zone (resource), Blackjack (resource), and additional exploration results from Hilltop, Granite Creek Underground, McCoy Cove, and new anomalies being tested in the Hilltop Corridor. Finally, investors can look forward to drill results from the FAD ground to the south. The wild card though to this investment thesis is a takeover, and while I'm not sure how many gold producers are interested given that this is evolving into a polymetallic opportunity blended with a gold opportunity which some gold miners may pass on if they want to stay gold focused, if the results get good enough or we see new polymetallic discoveries made (multiple untested anomalies on property) or they hit a high-grade porphyry, I would not be surprised to see larger base metal players like Teck Resources (TECK) start sniffing around.

As discussed, I'm not relying on any of this happening and I'm trying to model conservatively with information I have to date, but this would certainly lead to an accelerated re-rating. To summarise, I remain at an overweight position in the stock, and I would view any further weakness as a buying opportunity.

Disclosure: I am long IAU.TSX/IAUX

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. The author is not sponsored by any companies and never will be sponsored by any companies discussed in his writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.