It's been a rollercoaster ride of a year for investors in the Gold Miners Index (GDX), and many investors in the gold explorers/developers have taken a beating, with this not being surprising given that it's more difficult to raise capital, the prices that one must raise capital are less favorable, and nearly everything has become more expensive. In the case of the latter, this means that sustaining capital will be higher once a new mine is built, operating costs will be higher, drilling/development work will be more expensive with increased prices charged by contractors, the labor pool hasn't become any bigger which means it's tough to secure talent, and the cost to build the mine will be more expensive as well. The result of low equity prices and higher costs for nearly everything is that the average project is much less robust than it was in Q3 2020 (unless a major new discovery or a substantial increase in scale has changed the economics); each dollar raised will go less far due to these higher costs and lower share prices, and this means more share dilution - the last thing an investor wants.

Fortunately, a lot of this is priced into many developers and explorers, but this is still a difficult environment to raise capital. The outlook for most names is not nearly as attractive as we sat two years ago. That said, one group will benefit immensely from these developments, and these are royalty/streaming companies. This is because not only are streams and royalties looking like the lesser evil when compared to high-interest debt or significant share dilution at unfavorable levels, but some of the smaller royalty companies have already burned through their war chests, creating less competition than there was in 2020/2021 when many smaller companies were hungry for growth at any price. Within the royalty/streaming group, one name has stood out as being ultra-disciplined, digging in its heels, and not transacting in a frothy environment, and this is Osisko Gold Royalties (OR.TSX/OR). The result is that the environment for transacting is the best in years, and Osisko has saved nearly all its bullets, sitting on ~$600 million in liquidity plus substantial future cash flow from its ~100,000 GEO per annum attributable production profile.

In fact, now that the froth is out of the market and sentiment is in the doldrums, Osisko has been stepping up to make some new transactions are several are very nice little bolt-on deals in the small and mid-sized range. Some of them include the following with a nice mix of jurisdictional diversification, metals diversification, and very attractive prices paid for these deals, with Osisko even beating Franco-Nevada (FNV.TSX/FNV) on its price paid for a royalty on Alpala (Cascabel) in Ecuador.

- A 0.60% NSR on the Cascabel Property in Ecuador with the world-class Alpala deposit (potential future contribution of 7,000+ GEOs per annum)

- A 2.0% NSR on the Pipeline West/Clipper Gold Project and a 0.5% royalty on the Tokop Gold Project in Nevada

- A 1.0% NSR on the Kandiole Project in Mali that currently has a million-ounce resource (potential future contribution of ~2,000 GEOs per annum in its early years, depending on throughput rate)

- A 0.125% to 1.50% NSR on the AntaKori Project in Peru and a right to buy back a 1% NSR from a third party on AntaKori claims.

- A 1.5% NSR on the Acocarire Project and a 1.25% NSR on the Horizonte Project (near the Salares Norte Mine), with both located in Chile.

- A 1.0% NSR on the Marimaca Project in Chile, a very attractive copper project with modest upfront capex (potential future contribution of ~2,500 GEOs per annum, assuming a higher throughput rate is approved

Let's take a closer look at the company below:

All figures are in United States Dollars at an exchange rate of 0.80 CAD/USD unless otherwise noted.

Business Model

Osisko Gold Royalties is one of the largest royalty/streaming companies in the precious metals sector, with 20 producing assets, a portfolio of nearly 180 royalties/streams, and a clear differentiator vs. its peers, with most of its attributable production coming from Tier-1 jurisdictions (Canada, United States, Chile, and Australia). Assuming the company's transaction to lock up a silver stream (and a potential copper stream) on the high-grade CSA Mine in Australia goes through, this would further improve an already superior jurisdictional profile, with another 5,000+ GEOs per annum coming from the CSA Mine assuming the silver stream closes successfully. In addition, Osisko's major claim to fame is that it holds a massive 5.0% NSR royalty on the Canadian Malartic Open Pit and a 3-5% NSR royalty on Odyssey Underground (the second phase of Canadian Malartic, where mining is set to transition), with this being a top-10 gold mine globally from a scale standpoint. Notably, this asset has a very bright future with what looks to be 25+ million ounces of resources, and this asset is arguably the most attractive gold royalty asset in the sector currently, which royalty/streamers of any size would love to have in their portfolio.

(Source: Yamana Presentation, Osisko Gold Royalties Presentation)

While Canadian Malartic is clearly the company's crown jewel, its other producing assets are also very solid and helped to contribute to record gold-equivalent ounces [GEOs] earned in Q3, with Osisko Gold Royalties on track for a record year with 90,000+ GEOs. These royalty assets include a 5.0% NSR royalty on the Eagle Mine in the Yukon, a 100% Silver Stream on the Mantos Blancos Mine in Antofagasta, Chile, a sliding scale royalty on Newmont's (NGT.TSX/NEM) Eleonore, and a sliding scale royalty on what could be Canada's lowest-cost gold mine post-2025: Island Gold. However, the major development that many investors seem to have missed and which should have led to a sharper rally in the stock is that the company has finally succeeded in de-consolidating Osisko Development (ODV.TSX/ODV), making it a pure-play royalty/streaming company after a brief detour from this model following the acquisition of Barkerville Gold Mines and the messy financials even after it divested this asset.

Finally, the other key differentiator for Osisko Gold Royalties is that it has an industry-leading growth profile, with a goal to grow annual attributable GEO production from ~90,000 GEOs this year to ~140,000 GEOs by 2026. This translates to an 11.7% compound annual production growth profile, placing it in the top 10 names for growth within the sector among producers and royalty/streaming companies. However, with considerable liquidity and a market ripe for acquisitions, I would not be surprised to see Osisko beat its target of 130,000 to 140,000 GEOs in FY2026 with the potential to acquire another royalty or streaming asset in the producing or near-term production stage. Hence, I would consider the 130,000 to 140,000 GEO guidance for FY2026 as relatively conservative, and this figure doesn't do any justice to the company's long-term potential, which I see as 180,000 to 190,000 GEOs per annum, even without any new acquisitions.

(Source: Company Filings, Author's Chart & Estimates)

At those levels (190,000+ GEOs at a $1,900/oz average gold price), Osisko would generate over $280 million in annual cash flow, which could justify a nearly triple its current valuation, even at a cash flow multiple well below its largest royalty/streaming peers. Obviously, doubling its attributable GEO production profile won't happen overnight or even in the next three to four years. Still, this point is made to point out the depth and optionality within Osisko's portfolio, with multiple assets that have the potential to contribute 15,000+ GEOs per annum (Horne 5, Casino, Back Forty) and several with 5,000+ GEO per annum potential in the development stage (Windfall, Hermosa, Alpala, Kirkland Lake Camp [AK, Upper Beaver, Upper Canada]). Now that we have a decent primer on the company and its main assets and portfolio size, let's dig into recent developments:

Recent Developments

Although there have been several positive developments for Osisko Gold Royalties over the past year (continued progress at Hermosa by South32, positive drill results at Upper Beaver and Island Gold, and the addition of several new royalties), the major development affects the company's flagship asset: a 3-5% NSR royalty on Odyssey Underground. For those unfamiliar with Canadian Malartic, the Canadian Malartic Partnership {CMP] is transitioning to underground mining (Odyssey Project) after more than a decade of open-pit mining, which will extend the mine life to 2039. based on only a fraction of the project's current resources. Initially, this was considered a negative development for Osisko Gold Royalties, given that production at the asset will slide from ~800,000 ounces to ~600,000 ounces, and Osisko will switch from a 5.0% NSR royalty to a 3-5% NSR royalty and a $0.40/tonne processing royalty on any ore outside royalty boundaries sent to the Canadian Malartic Mill. While the 5.0% NSR covers the main deposits (East Gouldie, Odyssey South) and pre-commercial production will begin early next year, the result is that Osisko's attributable production will slide from a peak of 40,000+ ounces to 25,000 to 30,000 ounces post-2024.

(Source: Canadian Malartic Partnership Technical Report)

Assuming a $1,800/oz gold price, this is an $18 million hit to annual revenue, which isn't insignificant for a company of Osisko Gold Royalties' size. That said, this mine plan was completed in 2020, and several new developments have occurred since that time. Not only is the CMP adding ounces west of East Gouldie and seeing very solid infill results in the Odyssey internal zones, but it's also made a more than 1.0-kilometer step out east of East Gouldie, as shown in the below chart. This is great news for Osisko Gold Royalties, as is the fact that Agnico Eagle has launched a takeover offer to acquire the other 50% of Canadian Malartic, which would place this project in the hands of the most aggressive driller sector-wide. So, while the mine plan assumes average production of ~550,000 ounces from 2029-2039, which is a major step down from current levels, I think this is an asset that is ultimately capable of processing 900,000+ ounces per annum. The reason? While the production profile might be less than 70% vs. peak production, this production profile is based on utilizing less than one-third of this massive operation's mill capacity (19,000 tonnes per day vs. 60,000+ tonnes per day). Hence, it would make sense for Agnico to pull ounces forward in this mine plan.

(Source: Agnico Eagle Presentation)

What does this mean for Osisko Gold Royalties?

Assuming that Agnico Eagle processes an additional 15,000 - 18,000 tonnes per day post-2029 (5.5 to 6.5 million tonnes per annum) of material from pits or mines outside of its royalty ground, this would result in an incremental $2.2 - $2.6 million in revenue per annum or 1,200 GEOs to 1,500 GEOs, a small incremental boost. However, the bigger opportunity is if Agnico chooses to sink a second shaft to take advantage of the significant resource growth in the East Gouldie Extension. Assuming 11,000 tonnes per day was coming from Osisko's royalty ground (within the Rand Malartic property line), this would translate to an additional ~13,500 GEOs per annum attributable to Osisko. Plus, even under these assumptions (post-2029 opportunities), there would still be an additional ~10,000 tonnes per day of excess capacity at the plant. The chart below shows what this could look like conceptually for Osisko Gold Royalties attributable production from this asset, and as we can see, the royalty has the potential to generate over $80 million in revenue per annum post-2031 with a second shaft and top-up feed from other mines/open pits being fed to the Canadian Malartic Mill.

So, although we will see a temporary dip in Osisko Gold Royalties' attributable production from this asset, this will be easily covered by organic growth/new assets coming online elsewhere in the portfolio, and then this production starts to ramp up and could head above 40,000+ ounces per annum long-term. Hence, I don't understand the negative sentiment towards Osisko Gold Royalties' when it comes to this transition from open-pit to underground, given that while production is dipping temporarily, it's lower with an additional 40,000 tonnes per day waiting in the wings to be exploited. In fact, in a best-case scenario, Canadian Malartic could be a 1.0+ million-ounce producer post-2029, providing a very nice long-term boost to Osisko Gold Royalties' attributable production and helping it inch towards the 200,000 GEO per annum mark potentially.

(Source: Company Filings, Author's Chart & Estimates)

While the recent developments at Canadian Malartic are undoubtedly very positive, there are several assets already in production that will enjoy meaningful organic growth over the next few years (ahead of Malartic's likely expansion), with examples being Eagle (Project 250+), Island Gold (Phase III Expansion), Mantos Blancos Expansion (10MTPA potential), plus incremental growth at Lamaque. Of course, one can't forget Osisko's ~2.10% NSR royalty on Osisko Mining's (OSK.TSX/OBNNF) Windfall Project, which looks like it could generate upwards of $11 million in attributable revenue per annum for Osisko with a production profile of at least 6,000 GEOs per annum even without any positive grade reconciliation or a slight lift in recovery rates. This $11 million per annum revenue figure would translate to ~7% revenue growth vs. FY2023 levels for this asset alone. Finally, when when it comes to smaller contributors that could turn into meaningful contributors with a little work, Osisko Development's Tintic is one clear example.

At a current production rate of barely 20,000 ounces of gold per annum, this is a minuscule contributor currently based on a 2.50% gold stream held by Osisko Gold Royalties. However, the goal is to increase throughput from 45 tons per day to 500 tons per day by the end of 2024, with the completion of a surface decline to mine T4 material at a much higher rate. Assuming an expanded throughput rate of ~175,000 tonnes per annum and an average grade of 24.0 grams per ton of gold (20% below the grades mined year-to-date (31.1 grams per ton of gold), and 58% below the average grade in 2021 (59 grams per ton of gold) with improved recovery rates, Trixie's production profile would quintuple to ~110,000 ounces, increasing Osisko Gold Royalties' attributable production to ~2,700 GEOs per annum vs. 500 GEOs currently. In an upside case, assuming that grades exceed these levels (which isn't inconceivable with face sampling yielding grades of 20+ grams per ton of gold at T4 and 150+ grams per ton of gold at T2), this could be a ~3,000+ GEO per annum contributor for Osisko Gold Royalties, translating to $5.5 million in annual revenue which isn't bad at all for an upfront investment of $20 million.

(Source: Osisko Development Presentation)

It's worth noting that this is just one asset that is hardly even discussed with meaningful upside, but there is significant optionality elsewhere in Osisko Gold Royalties' portfolio, plus several smaller assets that aren't even being considered by the market. These assets might be just 1,000 to 3,500 GEO per annum contributors and appear relatively insignificant on their own. However, on a combined basis, they add up to 20,000+ GEOs per annum, or nearly the equivalent of another Canadian Malartic on an attributable basis, Osisko's flagship asset. Some examples are shown below, and they include Gold Rock (2,000 GEOs), WKP (3,000 GEOs), Upper Beaver (3,500 GEOs), Marimaca (2,200 GEOs), La Fortuna (1,000 GEOs), Kandiole (1,900 GEOs), Shovelnose (2,000 GEOs), West Kenya (2,000 GEOs), Tocantinzinho (1,400 GEOs), and several others (Oracle Ridge, CentroGold, Bralorne, AntaKori). Obviously, this assumes that all of these assets head into production by 2031, and not all of them will be green-lighted. Still, even if two-thirds of the small and large assets shown below head into production, Osisko would see an incremental 60,000+ GEO per annum increase in production on top of an already large base.

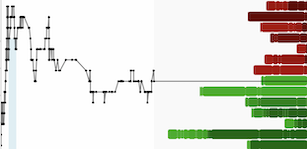

Valuation

Osisko Gold Royalties has ~185 million fully-diluted shares and a share price of US$12.10, leaving the stock trading at a market cap of $2.24 billion. If we compare that figure to an estimated net asset value of ~$2.21 billion, the stock is trading at just 1.01x P/NAV, which is a very attractive valuation when compared to its larger royalty/streaming peers at an average P/NAV multiple of ~1.75x P/NAV, and its closest peer Triple Flag Precious Metals (TFPM) at 1.20x P/NAV. In my view, this valuation makes little sense, especially with Osisko Gold Royalties finally shedding its messier profile after the de-consolidation of Osisko Development that has allowed it to claim the title of a pure-play royalty/streaming company. In fact, with the best jurisdictional profile among its peers and a portfolio with considerable depth (175 royalties/streams with several royalties/streams on world-class assets), I believe OR can easily command a P/NAV multiple of 1.50 - 1.60. Even at the low end of this range (1.50x), this translates to a fair value of ~$3.51 billion or US$18.65 per share [C$23.30 per share].

While this 54% upside to fair value may not be nearly the upside that investors can expect from higher-risk developers or small-cap producers, investors are taking on much less risk by owning Osisko with it being an inflation-resistant name and it having superior diversification to its peer group (20 producing assets) while still offering considerable optionality. Hence, on a risk-adjusted basis, I see Osisko as one of the best names to own in the sector, and I believe this multi-week pullback to US$12.00 per share could be providing the last great buying opportunity in the stock. So, if I were looking to round out my portfolio and add precious metals exposure without adding any meaningful risk due to the superior risk profile for royalty/streaming companies, I see Osisko Gold Royalties as one of the sector's best buy-the-dip candidates. Importantly, the fact that it's trading at a large discount to peers reduces this risk even further, with a meaningful margin of safety baked into the stock here. To summarize, I would view any pullbacks below US$11.90 as buying opportunities.

Disclosure: I am long AEM, OR, OSK

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.