Roughly two months ago, I wrote on Lundin Gold (LUG.TSX/LUGDF) noting that while the company was on track to deliver above the top end of its initial guidance, production was potentially set to peak in 2025 with lower grades with the company currently benefiting from mining above reserve grades from 2023 through 2025 in line with the mine plan. However, since quarter-end, we've seen a significant positive development, with the company revealing three-year guidance of ~490,000 ounces at ~$850/oz AISC on average, well above my prior estimates due to plans to boost recoveries and increase through at its massive mine in Ecuador. In this update we'll dig into the Q3 results, the stock's updated valuation, and whether the stock is offering enough margin of safety to begin buying the dip.

Fruta Del Norte Mineralization - Geology & Origin of the FDN Epithermal Gold Silver Deposits, S. Leary, R. Sillitoe, P. Stewart, K. Roa, B. Nicolson

Q3 Production & Sales

Lundin Gold released its Q3 results last month, reporting quarterly gold production of ~112,200 ounces, and ~382,000 ounces year-to-date. This translated to an ~8% decline from the year-ago period, but this was largely expected because of lapping grades well above reserves at 11.0 grams per tonne of gold in Q3. As for year-to-date production, the company is sitting at ~82% of its already upward revised guidance midpoint, with the company noting that it expects to be near the upper end of its guidance. These results are exceptional even if they're what we've come to expect from Lundin Gold's CEO Ron Hochstein and his team, with the company being one of the most consistent producers for over-delivering on promises.

Lundin Gold - Quarterly Gold Production - Company Filings, Author's Chart

Digging into the results a little closer, the Fruta del Norte Mine processed ~416,100 tonnes in Q3 at an average grade of 9.0 grams per tonne of gold, translating to an increase in throughput but with tough comparisons on grade (Q3 2022: 11.0 grams per tonne of gold). And while this should have been a ~115,000 ounce quarter, Lundin Gold noted that recovery rates were negatively impacted by processing ore with higher levels of finely disseminated sulphide minerals, which lowered flotation recoveries. The result was recoveries that came in at just 86.5% in the period, a nearly 400 basis point decline year-over-year. On a positive note, pilot testing of Jameson Cell technology has yielded positive results, and the company expects that as part of its growth plans (~$36 million cost), it can not only ramp up to 5,000 tonnes per day (~4,500 tonnes per day currently), but deliver a 300 basis point improvement in recoveries by adding three Jameson cells to its operation.

Assuming a constant head grade of 9.0 grams per tonne of gold and a 5,000 tonne per day throughput rate, a 3% lift in recoveries would translate to an additional ~15,800 ounces of gold recovered per annum.

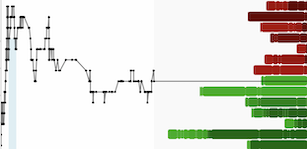

Lundin Gold - Operating Cash Flow, Free Cash Flow & Cash/Cash Equivalents Balance - Company Filings, Author's Chart

Moving over to the financial results, Lundin Gold reported revenue of $211.2 million on the back of a higher gold price, a marginal increase year-over-year despite lower gold sales. This translated to an increase in operating cash flow to $120.0 million and free cash flow of $80.9 million, which was more free cash flow than many million-ounce producers generated in the period. Meanwhile, the company ended the period with ~$302 million in cash and cash equivalents ($1.24 per share), and just $70 million in net debt currently after paying off the remainder of its debt facility. Notably, this was completed almost three years ahead of schedule, an impressive feat for any new producer with a single asset.

Costs & Margins

Moving to costs and margins, the company reported cash costs of $704/oz and all-in sustaining costs of $907/oz, translating to an increase vs. all-in sustaining costs of $807/oz in the year-ago period. However, it's important to note that sustaining capital was higher because of the purchase of mobile equipment, its fourth TSF dam raise, upgrades to the sewage treatment plants, and the commissioning of its underground mine maintenance facility (latter expected to provide cost savings). In addition, the company was lapping a period with sales of ~134,600 ounces of gold, making it very difficult to lap these tough comparisons. Besides, all-in sustaining cost margins still rose to an industry-leading $1,024/oz (Q3 2022: $811/oz) on the back of a rising gold price, and we should see another impressive year with FY2024 AISC guidance of $855/oz at the midpoint.

Lundin Gold - Quarterly Production & AISC - Company Filings, Author's Chart

Finally, regarding next year's plans, Lundin Gold has approved an expansion to 5,000 tonnes per day, and has a busy year of exploration on deck with plans to drill 56,000 meters (near-mine and regional drilling). The result of the planned expansion that will be completed by year-end 2024 is a production profile of ~ 500,000 ounces in 2025 and 2026 despite declining grades, helped by better recoveries and 10% higher throughput. Meanwhile, all-in sustaining costs will remain at industry-leading levels below $900/oz, and could decline to as low as $800/oz in 2026 or over 40% below the expected industry average in FY2026 (~$1,450/oz). Hence, my previous worry that costs could rise with slightly lower production as grades normalize has been averted and Lundin will maintain its spot as a top-3 gold producer from a margin standpoint over the next few years.

Recent Developments

Moving to recent developments, the company has been vocal that it would look at M&A in past updates. So, given the openness to M&A, I'm a little surprised that it hasn't taken advantage of its well-priced currency to make an acquisition, especially with it being a single-asset producer in a non Tier-1 ranked jurisdiction where it's difficult to maintain double-digit free cash flow multiples (regardless of deposit quality). And while its currency is still favorable, the stock is now down ~20% from its highs, while many developers and smaller producers have outperformed after being in freefall for most of 2023. However, in Lundin Gold's defense, it isn't easy to find development projects or smaller producers with similar quality assets, and there certainly aren't that many options with sub $950/oz all-in sustaining costs.

Lundin Gold vs. ASA Gold & PM Ltd. - StockCharts.com

That being said, this is a rare period where quality is on sale and/or reasonably valued, with examples like De Grey Mining (DEG.ASX), Skeena Resources (SKE.TSX/SKE), Rupert Resources (RUP.TSX/RUPRF) and Marathon Gold (MOZ.TSX/MGDPF). These projects are capable of adding 200,000 to 550,000 gold-equivalent ounces per year at costs ranging from ~$750/oz to ~$1,050/oz. And while the former (Hemi) will require significant upfront build costs given its refractory ore coupled with more expensive labor in Australia, any of these assets would be a decent fit with minimal impact to margins and a decline in jurisdictional risk. So, with the current environment leaving even quality developers completely detached from the gold price, it is strange to see the lack of M&A in the mid-tier space that we have, and not just from Lundin Gold but other producers that might have an appetite to diversify like Centerra (CG.TSX/CGAU), Silver Lake (SLR.ASX) (albeit it may be gunning for Red 5), and Perseus (PRU.TSX/PMNXF).

Undeveloped Gold Projects - Estimated Gold-Equivalent Production & Upfront Capex - Company Filings, Author's Chart & Estimates

Valuation

Based on ~243 million fully diluted shares and a share price of US$11.32, Lundin Gold trades at a market cap of ~$2.75 billion and an enterprise value of ~$2.82 billion, making it the highest capitalization single-asset producer in the gold sector by a wide margin. In fact, the stock's current enterprise value is nearly double that of names like OceanaGold (OGC.TSX/OCANF) with a similar production profile, and significantly above other mid-tier producers like Iamgold Iamgold (IMG.TSX/IAG) Equinox Gold (EQX.TSX/EQX) and Torex Gold (TXG.TSX/TORCF) Obviously, some of this can be attributed to Lundin Gold's industry-leading margins, well above-average grades, track record of over-delivering on promises, and phenomenal track record of reserve replacement. Still, the current valuation leaves Lundin Gold trading at a slight premium to its estimated net asset value of ~$2.74 billion, even if it trades at one of the lower free cash flow multiples sector-wide.

Using what I believe to be fair multiples of 1.1x P/NAV and 8.5x FY2024 cash flow estimates and using a 65% weighting to P/NAV and 35% assigned to P/CF, I see a fair value for the stock of US$13.95. Although this points to a 24% upside from current levels, I am looking for a minimum 35% discount to fair value to justify starting new positions in single-asset producers. Hence, while Lundin Gold may be down ~20% from its highs, it's hard to argue that there's enough of a margin of safety here just yet unless the company is on the eve of making a major new regional discovery at Fruta Del Norte which would be a game-changer, and it certainly has the right address. Hence, while I see Lundin Gold as one of the better buy-the-dip candidates at the right price, I am more focused on other names currently trading at a deeper discount to fair value, such as Argonaut Gold (AR.TSX/ARNGF) at just ~0.40x P/NAV (~0.30x P/NAV if it pursues the expansion case at Magino), and less than 1.5x FY2024 P/CF.

Summary

Lundin Gold continues to fire on all cylinders, is on track to beat upward revised guidance once again, and continues to enjoy some of the highest margins sector-wide. Meanwhile, the company has extinguished all of its bank debt and will be a free cash flow machine next year, with room to increase its dividend if it can't find a better use for its growing cash position. That said, the stock may be reasonably valued, but I am looking for significant discounts to fair value or I prefer to pass entirely. So, while Lundin Gold ranks high on quality and gets extra points for its strong balance sheet and ability to consistently over-deliver, I would need a pullback below US$9.10 to become more interested in the stock.

Disclosure: I am long AR.TSX, ARNGF, MOZ.TSX, MGDPF

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.