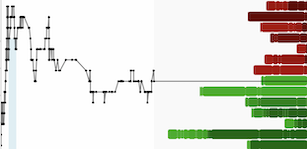

It's been a rough two years for investors in the precious metals’ developer space with several names sinking over 50% from their highs, and many trading near multi-year lows. For many, this is likely frustrating given that the gold price is sitting just ~7% from all-time highs, but while the gold price helps the producers who are mining and selling gold every day, it doesn't help the developers that may not see first gold for years, or even within this decade.

Instead, the more relevant metrics to watch for developers are interest rates (cost of capital and to decide on a more reasonable discount rate), their ability to raise capital (the health of junior equity markets), and inflation levels. The latter is important because while developers may not have to worry about operating costs, they are highly dependent on contractors and labor at their camps as they move towards ultimate construction (if a junior truly owns an exceptional asset), and inflation from a capex standpoint which will ultimately determine how much it costs to build a mine. So, while the gold price has been working in favor of the developers (a minor win since it will likely average $1,850/oz or higher by the time those that reach producer status start producing), this has been more than offset by higher salaries for employees, higher contractor costs and higher costs to build mines.

Simultaneously, this is the worst equity market for juniors (elevated interest rates and weak share prices) in years and juniors cannot rely on cash flow to pay the bills. This means that not only is each meter drilled, hour worked at camps, and study completed costing more, but each share sold is going less far to pay for these higher costs due to depressed share prices. The result is higher levels of share dilution than most expected to reach first gold pour, higher-cost debt for the debt portion of mine builds, and higher operating costs once in production for miners relative to most of their stale studies done in 2020/2021. Making matters worse, one could argue that a more reasonable discount rate for developers in Tier-2/Tier-3 jurisdictions that are pre-Feasibility is 10%, and 8% for Tier-1 jurisdiction developers when the risk-free rate is ~5.0%. Shifting to a higher discount rate puts a severe dent in the value of these companies when their NPV figures plummet.

Finally, while some investors are scrambling to recalculate in-situ values to market cap for their juniors and proclaiming these stocks are cheap, this figure (low market cap to initial capex ratio or low market cap relative to in-situ value) is arguably a better predictor of poor returns as those companies with ultra-low ratios are unlikely to be able to finance mine builds until this figure improves. To summarize, while there’s no question that developers have been beaten up and are cheap, they are cheap for a reason and in the case of some developers, they’re still not cheap enough as the ~50% increase in upfront capex, high double-digit rise in sustaining capital and higher operating costs have turned mediocre projects into unfeasible projects, good projects into mediocre projects (also likely unfeasible), and made it so that only great projects (that are now just good projects) will be developed without much higher gold prices.

The good news is that there are always exceptions to the rule of avoiding developers, and for those willing to dig through the rubble, Osisko Mining (OSK.TSX/OBNNF) looks to be one of these exceptions. This is because it has a major gold producer as a partner in Gold Fields (GFI), it has one of the best undeveloped gold projects globally that ultimately looks like it could boast a 12+ million-ounce resource property-wide (~7.4 million ounces with M&I grade of 11.4 grams per tonne of gold), and the recent partnership on Windfall has helped Osisko to move to fully-financed status. Assuming $890 million in estimated cost to completion on a 100% basis which is shared by Gold Fields and Osisko, Osisko’s share would come in at ~$445 million, less than the ~$480 million in cash payments to be made to Osisko as part of the joint venture. Plus, Osisko’s expenditures on exploration will be lessened in the near-term despite an increase in exploration, with Gold Fields agreeing to fund ~$57 million in exploration over seven years to help with making new regional discoveries. Hence, while Osisko is a developer, it does not carry the same risks from a financing standpoint, and we should see limited share dilution going forward.

(Source: Company Website)

All figures are in United States Dollars unless otherwise noted.

The Windfall Project

While there are several world-class undeveloped gold projects globally, few enjoy the attributes that make Windfall unique. These attributes are a sub $1.0 billion construction costs, industry-leading all-in sustaining costs of sub $825/oz (inflation adjusted), a significant production profile of ~300,000 ounces per annum even if we don’t see positive grade reconciliation (which looks likely given the restrictive top cuts) and an asset with significant near-mine potential (along strike, at depth, and regionally) with a high likelihood that the ~3.2 million ounce reserve base ultimately grows to 6.0+ million ounces (not adjusting for mined depletion). Finally, the project benefits from being highly de-risked with ~1.9 million meters of drilling completed, ~270% more meters than what was drilled at Pretium’s Brucejack Project prior to it going into production in June 2017. Hence, I would argue that Windfall has much lower operational risk when it comes to achieving planned grades/tonnes than other narrow-vein underground gold mines, especially given the impressive outperformance from a grade and tonnage from previously completed bulk samples (161% average positive grade reconciliation, with best result of 189% positive grade reconciliation in the Lynx 311 bulk sample).

(Source: Company News Release)

Osisko’s bulk sample results actually beat Pretium’s bulk sample results in 2013 with 47% higher gold produced in Pretium’s bulk sample vs. 61% more ounces produced across Osisko’s three bulk samples.

As highlighted in a recent presentation, Windfall certainly stands out among its peers with a ~7.4-million-ounce resource base, but it’s important to note that this resource is contained to just a fraction of the overall Windfall Camp and the company’s total landholdings spanning from Windfall to Lebel-sur Quevillon. In fact, the company’s total land package sits at 2,400 square kilometers, nearly double the size of the 1,400 square kilometer Val D’Or Mining Camp which has produced over 100 million ounces of gold to date, and still holds an inventory of ~30 million ounces of gold at currently producing mines, suggesting this figure is likely to grow to upwards of 125 million ounces, if not higher. And historically, the best place to make a major discovery is next to an already productive mine, evidenced by the CM Partnership’s success at Canadian Malartic, with ~15 million ounces of resources proven up at Odyssey (underground) just as the open pit heads towards the latter portions of its mine life at Canadian Malartic. So, while there are no guarantees when it comes to gold discoveries, I would argue that there’s a high probability that the company has another multi-million-ounce opportunity on this land package, and it could be in close proximity to its future mill (grinding mills have capacity of 3,900 tonnes per day or 15% above planned throughput rate), with impressive drill results coming out of Golden Bear (north of Windfall), as well as solid hits from regional targets like Fox and Fox West (3.1 meters at 27.6 grams per tonne of gold, 2.8 meters at 16.7 grams per tonne of gold).

(Source: Gold Fields Presentation)

In addition to regional potential, there is further upside near-mine, evidenced by Osisko’s drill results last year. For those that missed, Osisko drilled to test the down-plunge extension of the ultra-high-grade Lynx 4 Zone (mean uncapped composite grade of 18.8 grams per tonne of gold) and hit 3.5 meters at 81.8 grams per tonne and 4.1 meters at 22.3 grams per tonne of gold at a vertical depth of 1,670 meters, well below the ~1,100-meter cut-off for the current mine plan. Notably, these intercepts were over 600 down plunge from the nearest resource block at Lynx 4 wireframe 3449. Just as important to increase the probability that this zone is an extension, Osisko noted that the mineralization is similar to that found in Lynx 4, with disseminated pyrite associated with strong pervasive silica alternation hosted in a sericitized gabbro (including local visible gold). So, with gold deposits in the Timmins and Val D’Or Camp continuing to depths past 2,000 meters (3,000+ meters in the case of LaRonde and Red Lake) and this being one of the richest new discoveries in North America in over a decade from a grade standpoint (rivaling Fourmile), it wouldn’t be shocking if this continued to 2.0 kilometer depths, and mineralization has already proven to extend to 2.7 kilometers with the Deep Discovery Hole drilled in 2019.

Given the several positive developments over the past 24 months (continued strong bulk sample results, a new gold major as a partner in Gold Fields, further exploration success regionally, along strike, and down-plunge), I don’t think it’s unreasonable to model a 15-year mine life vs. the 10-year mine life assumed in the 2022 FS. In addition, I don’t think it’s that unreasonable to assume positive grade reconciliation of 5% over this mine life and a higher production profile starting in Year 6 with the partnership likely to look at optimizing this asset to push it closer to a 350,000 ounce per annum production profile. Assuming these upside opportunities come to fruition (longer mine life, slightly higher grades, higher throughput rates later in mine life), we could see the actual production profile come in closer to ~345,000 ounces vs. ~294,000 ounces expected in the 2022 FS. And even if we make conservative assumptions and assume higher mining, milling, and G&A costs vs. the 2022 FS to account for inflation, Osisko’s estimated NPV (6.5%) post-construction comes in at ~$1.02 billion at an $1,875/oz gold price, well above the estimated NPV (5%) of ~$1.25 billion NPV (5%) at a $1,900/oz gold price in the 2022 FS.

Recent Developments

As for recent developments, there’s been a significant slowdown in news from drilling, but this can partially be attributed to wildfires that began in June. The result was that there was a significant decline in activity on site, with the Windfall Partnership resuming operations in mid-July. That said, despite the lack of drilling and development updates (vs. the previous cadence of roughly one update per month), the project continues to progress according to plan, with the Windfall Environmental Impact Assessment [EIA] submitted in March, suggesting permits will be granted in June 2024 assuming a 15-month approval timeline. Meanwhile, the exploration ramp has advanced over 12,100 meters and the Lynx underground exploration ramp was sitting at a vertical depth of 640 meters as of quarter-end. Finally, the company noted that the installation of LTE infrastructure has begun underground, and the construction of a new pumping station is underway on the 460-meter level which should be completed before year-end. This significant program on early construction works has also de-risked the project, with nearly 13 kilometers of underground development completed to date, suggesting the potential to be pouring first gold by year-end 2026.

Let’s dig into the stock’s valuation and see whether this offers an adequate margin of safety for the stock:

Valuation

Based on ~450 million fully diluted shares and a share price of US$1.96, Osisko Mining trades at a market cap of ~$882 million, which might make it appear close to fully valued compared to an estimated attributable NAV of ~$1.02 billion. However, when it comes to an asset of this quality that’s shared with a top-10 gold producer by scale, I believe a 1.1x P/NAV multiple is not unreasonable, placing its attributable value of Windfall at ~$1.12 billion. Plus, with a massive land package where the Windfall Partnership hasn’t even scratched the surface (including Golden Bear) I believe it’s more than reasonable to assign $200 million in exploration upside for Osisko’s 50% share of this massive land package. Finally, Osisko should have nearly ~$100 million in additional cash outside of its commitments to build its half of Windfall, totaling a fair value of ~$1.42 billion. If we divide this figure by 450 million fully diluted shares (which includes dilution from converts), Osisko’s fair value comes in at US$3.16, pointing to a 61% upside from current levels.

Summary

As noted in previous updates, I sold my position in Osisko Mining for a ~25% gain in March, and I was in no rush to buy back my position following the Gold Fields deal given that half of the project had been given away for a lower price than I expected, even if it was de-risked. Plus, this deal had taken the accelerated path to a re-rating off the table for Osisko given that the hope that this might be a takeover with a quick 40-50% premium was no longer a likely scenario. That said, the stock has since dropped over 40% from the Gold Fields deal and is back to trading at a ~40% discount to fair value, offering an adequate margin of safety for starting new positions. Therefore, I have recently started a new position in the stock, and I see Osisko as one of the better/reward setups in the developer space following its violent correction.

Disclosure: I am long OSK.TSX/OBNNF

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.