Original Link: https://www.smallcapinvestor.ca/post/a-tech-pioneer-with-a-billion-dollar-aspiration-american-aires-cse-wifi

If you are thinking about branching out your investment portfolio and want something different from the usual metals and mining scene, then you need to check out American Aires (CSE:WIFI). The story is easy to understand and it is one that should resonate very well with the retail market.

Some of the highest flying deals I have witnessed in the venture market were companies that attempted to tackle a real-world issue with technology and this is exactly what American Aires plans to do.

At first glance, Aires appears to be just another retail product business. But a second look reveals that it is a fusion of life sciences and technology.

In my own personal opinion, this is a one of a kind story and a once in a lifetime opportunity.

The company has dedicated over 20 years and $20M to developing proprietary nanotechnology that shields consumers from EMF radiation exposure — an increasingly pressing concern in our technology-dependent society.

Now, you might think this sounds far-fetched, but a wealth of scientific research and studies supports the harmful effects of EMF radiation and validates the efficacy of American Aires' nanotechnology in mitigating these risks.

EMF FIELDS: A GLOBAL CONCERN

Electromagnetic fields (EMFs) are invisible energy areas, often referred to as radiation, associated with electrical power use and various natural and man-made lighting forms. Using a cell phone, laptop, or having a wireless router in your home means constant exposure to EMF waves. In our technology-reliant world, avoiding EMF radiation is impossible.

Here is a fact you probably didn’t know. Placing a simple LED light near the antenna on the back of your phone can actually cause the LED to light up, which shows the sheer amount of energy that is being emitted by your cell phone.

With the advent of modern technologies like smartphones, WiFi, and 5G networks, EMFs have increasingly sparked health concerns. Research, including over 1,000 studies from the US and around the world, has highlighted adverse effects associated with EMFs, particularly emanating from smartphones, WiFi routers, and the rollout of 5G networks.

In 2017, the World Health Organization labeled cell phone radiation as a Type 2 carcinogen, underscoring its potential risks {https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5504984/}.

Furthermore, France recently took a bold step by banning the iPhone 12 nationwide after it was found to exceed European radiation exposure standards {https://www.reuters.com/technology/why-has-france-banned-sales-apples-iphone-12-2023-09-13/}.

Concerns also extend to the risk of parotid gland tumours, with evidence suggesting that regular mobile phone use—especially extensive use over five years or in rural areas where higher radiation levels are necessary—significantly increases this risk {https://www.magdahavas.com/wp-content/uploads/2009/12/Mobile_Phones-not_just_about_brain_tumors1.pdf},

Another critical area of research is the impact of radio-frequency radiation on fertility. Male infertility has become a pressing public health issue, with sperm counts declining by 50% over the past few decades. A study by the University of Geneva and the Swiss Tropical and Public Health Institute suggests a possible link between smartphone usage and reduced sperm concentration and total sperm count in young adult males, highlighting the broader implications of our interconnected, digital lives.

THE TECHNOLOGY

American Aires has developed a unique solution to the challenge of EMF (electromagnetic field) exposure: a proprietary silicon-based microchip. This microchip is ingeniously crafted to reduce the potential negative health effects associated with EMFs.

The concept originated when the inventor was working with the Russian military to develop radiation protection technology for radar station personnel without blocking the signal. The US military also investigated biological and behavioral effects on radar personnel back in the 1940-60s, which were linked to multiple cases of DNA breaks, brain cells damage, significant effect on animals and even firefighters.The founder of American Aires then adapted this technology for the retail market.

The functionality of the chip is as follows: It features a resonator antenna on the front that captures charge from surrounding EMFs, with a similar mechanism on the back. There are millions of etchings within the silicon resonator chip. Those etchings take the structured man-made electromagnetic wave and diffract the waves to the point where they are no longer harmful to the human body. This is why it does not interfere with the transmission of data — it doesn’t block or remove the EMF waves, it modulates them.

DOES IT ACTUALLY WORK?

The effectiveness of the Aires microchip in stabilizing EMF waves has garnered considerable interest in the scientific community. A significant study published in the well-respected Springer Link journal has validated its stabilizing capabilities. Reinforcing the credibility of this technology, a compilation of eight peer-reviewed studies, five scientific articles, and twenty-five clinical and scientific reports have collectively affirmed the efficacy of the Aires microchip. This impressive aggregation of research and scholarly documentation underpins the company's claims about the chip's performance, offering a solid, scientifically grounded basis for its effectiveness.

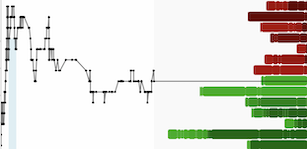

AiresTech invited several customers to test out the effectiveness of their products using an electroencephalogram (EEG) which measures electrical activity in the brain using small, metal discs (electrodes) attached to the scalp. The red represents brain asymmetry, while the green represents stable brain function.

On the left, is what your brain looks like after 10 minutes on the phone without Aires Lifetune device. On the right, is what your brain looks like after 10 minutes with Aires Lifetune. The difference is night and day.

Here is the full video:

CUSTOMER BASE

To estimate the market potential for American Aires products, the company has identified diverse customer segments, including biohackers, tech-savvy athletes, individuals focused on fertility, those seeking better sleep, and most recently, gamers.

American Aires has identified the U.S. market alone as having a $5 billion potential but this is just a fraction of the global opportunity. Penetrating the U.S. market poses unique challenges due to its diverse population. Recognizing this, American Aires has already started expanding into other regions, including Australia, Europe, and the UAE, where they have been achieving early success.

The company's products have been particularly popular among high-performing athletes and celebrities who value health and wellness. Notable celebrities that have either endorsed or have been seen with AiresTech products include Kim Kardashian, Ben Greenfield, Tiki Barber, Maycee Barber, and Gary Brecka, among others.

American Aires operates an online direct-to-consumer sales model, with fulfillment centers in the USA, Canada, Australia, and the EU. Despite their current customer base spanning 54,000 clients across 65 countries, with the U.S. making up 80% of sales, the company believes it has only begun to tap into its full market potential.

THE NUMBERS

As previously mentioned, Josh Bruni, the CEO of American Aires, assumed leadership in late 2021 and has since revamped the company's market strategy, placing a strong emphasis on high-performance.

This shift has yielded impressive results: the company has been consistently doubling their revenues over the last two years. For the first 9 months of 2023 the company reported $5.5 million based on public filings, which represents YOY growth of 63%. Extrapolating this growth rate over the whole 2022, Airestech could be sitting on $10M in 2023 sales.

The company's revenue growth has been robust, but it's the profit margins that are the real kicker. Presently, the gross margins on their products stand at around 60%, indicative of a highly profitable business benefiting from economies of scale. Compare this to one of the most profitable companies on the planet, Apple Inc, which reported gross margins of around 45% last quarter.

A key milestone for American Aires has been achieving positive EBITDA (adjusted) in their most recent quarter (Q3 2023) . This achievement is especially significant considering the company's uncertain access to capital, necessitating a lean operational budget. Their focus on efficiency and margin optimization has been a crucial factor in this success. With ~60% gross margins, a cash injection like the recently oversubscribed $4M financing should allow them to scale up revenues significantly while greatly increasing profitability.

THE PATH FORWARD

Since the CEO Josh Bruni took over in 2021, the company has impressively doubled its revenues year over year. Having had the opportunity to speak with Josh, I can personally attest to his remarkable product marketing skills. He possesses a unique ability to engage and persuade. This guy could sell ice to a polar bear. His extensive experience in sales and digital marketing across various brands and industries positions him as the ideal leader to potentially elevate the company's sales beyond the $1 billion mark.

Josh's strategy is to sustain this remarkable trend of 80-100% revenue growth. He plans to achieve this by enhancing a data-driven, methodical, and iterative growth engine. This strategy involves tapping into VaynerMedia's extensive expertise in brand building on a grander scale and fostering deeper connections with top athletes and performers to boost the company's visibility and credibility.

Part of this strategic plan includes forming a partnership with a professional North American sports league, aiming to significantly enhance mainstream appeal and brand recognition.

Moreover, the company is ambitiously looking to expand into more international markets, including the UK, Hong Kong, France, Italy, Germany, and Scandinavia. This expansion will leverage existing infrastructure, potentially leading to cost efficiencies and a strengthened global brand presence.

VALUATION

I’ve built a forecast for American Aires to showcase the potential over the next five years if the company can execute on their plan. The results are astounding.

I used a few different assumptions in the model based on conversations with the CEO:

Assumptions (based on conversations with mgmt):

- 100% annual revenue growth in 2024 due to incremental partnerships - also in line with previous years (2021-2023). Growth rate drops to 80% in subsequent years.

- Decrease in COGS (increasing margins) over time as unit costs are expected to decrease as order quantity increases. Currently not receiving any discount for order size - price per unit decreases when bulk ordering.

- Marketing and advertising spend will stay consistent as a percentage of revenues.

- Expect office/salaries to increase slightly year-over-year.

- Slight dilution over the coming years as the company will need to raise additional equity to expand internationally.

Based on these assumptions, I expect that the company will achieve positive net income in 2025 and this will ramp up quickly due to the high-margin nature of the business.

I then took the industry average earnings multiples for the ‘consumer electronic’ and ‘general retail’ segments (Link to Study), which came out to 29.43x and multiplied that by projected EPS in each year - resulting in a valuation of roughly $76M ($0.70 per share) in 2025, $276M ($2.30 per share) in 2026, $797M ($6.13 per share) in 2027, and $1.4B ($10.44 per share) in 2028.

SHARE STRUCTURE

A good deal is nothing without a proper share structure and WIFI also excels in this category. The company was recently rolled back 10 for 1 and subsequently converted all of their debt into shares, resulting in a basic shares outstanding of only ~60M and a clean slate in terms of shareholders. After the most recent financing, the share count has increased to 86M. More importantly, management has significant skin-in-the-game, holding over 35% of the outstanding shares.

BLUE SKY POTENTIAL

With their current revenue figures, American Aires has only scratched the surface of their impressive $5 billion addressable retail market. There is no real competition with the same quality as Aires product, so if they are able to capture the entire market, I could easily envision this company being valued at over $1 billion in the future. Beyond the retail market, there is an untapped goldmine in the B2B sector, and the company has already piqued the interest of the agriculture and pet industries.

Now, here's where it gets exciting: the real untapped blue-sky potential lies in the realm of Original Equipment Manufacturer (OEM) opportunities. Imagine everyday products like phone cases, headphones, or even cell phones themselves, enhanced with an Aires Microchip. American Aires has already started along this path by signing an OEM deal with a Sleep Mask manufacturer. By aligning with consumer interests, the company has been setting the stage for a wave of OEM partnerships. The company's reach extends across a range of high-volume segments, including smartphones, laptops, gaming accessories, electric vehicles, and various health-related products for babies, pets, and children, as well as essential goods and services for daycares, schools, hospitals, fertility clinics, offices, and the hospitality sector. The scope for integration is truly limitless.

THE BOTTOM LINE

American Aires (CSE:WIFI) stands as a beacon of innovation and potential within the tech and life sciences sector, promising to revolutionize the way we approach EMF radiation protection. With over two decades dedicated to pioneering proprietary nanotechnology, the company has positioned itself as a leader in mitigating the risks associated with our increasingly technology-dependent lifestyle. Through meticulous research and development, Aires has crafted a solution that not only addresses a global concern but also opens up a vast market opportunity, from direct consumer sales to potential OEM partnerships and beyond. The company's impressive financial performance, strategic market expansion, and commitment to product efficacy underline its ambition to not just succeed but to lead and redefine industry standards. For investors seeking to diversify with a company that combines cutting-edge technology with significant market potential and a commitment to societal well-being, American Aires represents a unique and compelling opportunity. As it continues to explore new frontiers and expand its global footprint, the journey of American Aires is not just about creating value but about shaping a safer, more connected world.

DISCLOSURE & DISCLAIMER

The publisher of this report was compensated by Torque Capital Partners for the publication of this and other reports regarding the Issuer. The purpose of this compensation was to cover the author's time, research, and expertise in analyzing the company. It is important to note that the payment received may create a potential conflict of interest, as the author may be influenced by the compensation received. Readers are advised to consider this disclosure when evaluating the credibility and objectivity of the information provided in the article. The author owns shares in the Issuer and, from time to time, may purchase or sell additional securities.

The information contained in this article is not intended to induce the sale of a security. You should not rely on the information herein as investment advice. The Creator is a marketing and advertising company, and is not registered to act as a broker, dealer, investment adviser or in any similar capacity in any jurisdiction. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on the information on www.smallcapinvestor.ca. This Promotional Activity is intended to highlight the Client for your further investigation; this Promotional Activity is not a recommendation. Please do your own research before investing, including reading the Client’s SEDAR+ filings, news releases, and risk disclosures. Information in this Promotional Activity was provided by the Client, extracted from the Client’s website’s website and/or SEDAR+, and/or extracted from other publicly available sources.

This disclosure is intended to provide transparency and assist readers in understanding the context in which the article was written. From time to time, the author of this report, the publisher, and the publisher’s directors, officers, and other insiders may purchase or sell securities of the Issuer.