COAL IS STILL KING

For millennia, coal has served as a vital source of heat and energy for human civilizations. Its significance became pronounced during the Industrial Revolution as the development of coal fired steam engines allowed the concentration of industry in cities and eliminated the dependence on water and wind power. In the modern era, there has been a shift away from coal and towards cleaner energy sources, reflecting a collective commitment to environmental sustainability and a low-carbon future. However, despite this ongoing shift, the truth of the matter is that coal is still KING when it comes to global electricity generation.

This may come as a surprise to many but as of 2022, roughly 35% of the world's electricity was still derived from 9,000 operation coal plants, surpassing natural gas at 22.7% and hydroelectric at 14.9%. In the United States, the amount of electricity generated from coal was around 19.7%, and in Canada, it was around 5.7%. In developing countries, this number was much larger, predominantly due to coal’s cost-effectiveness as a fuel for power generation. China & India are burning record amounts of coal & using renewable energy as a complement not a substitute.

It's undeniable that coal maintains its dominance as the world's largest single source of electricity and this trend is expected to persist into the foreseeable future. Analysts predict that even by 2040, coal will still contribute a substantial 22% to global electricity generation.

This enduring appetite for coal is underscored by significant moves made by major industry players, highlighting the industry's resilience and ongoing relevance.

COKING COAL VS THERMAL COAL

In order to better understand the dynamics of the coal market it is helpful to know the difference between Coking coal and Thermal coal, which differ significantly in their applications and properties.

Coking coal, also known as metallurgical coal, boasts a high carbon content and is low in impurities, making it an essential ingredient in the steelmaking process. Its primary role is to undergo a coking process, wherein volatile components are eliminated, leaving behind coke—a vital material in blast furnaces for steel production.

Thermal coal, or steam coal, serves a distinct purpose as a source of energy for electricity generation. While it may have a lower carbon content compared to coking coal, thermal coal is valued for its combustion properties, supplying the necessary heat to produce steam that drives turbines in power plants.

These disparities in composition and utility highlight the specialized roles each type of coal plays in industrial processes, with coking coal shaping the backbone of steel manufacturing and thermal coal powering the global electricity grid.

TECK’S $8.9 BILLION DEAL WITH GLENCORE

The latest headline-maker in the coal industry is the announcement of Teck's monumental $8.9-billion deal to sell its steelmaking coal business to Glencore, Nippon Steel, and POSCO. Glencore's acquisition of Teck Resources' steelmaking coal unit highlights the enduring appeal of cheap fossil fuels - for at least a decade or two - even as they are phased out in favour of renewable energy.

While Western companies may be hesitant to explore new coal sources or develop new mines, investors are recognizing coal's continued importance in meeting the rising demand during the transition to cleaner energy. Demand for coal in developing countries remains stronger than ever.

Glencore's purchase of Teck's coking coal business positions it as a formidable coal player, with analysts estimating annual free cash flow between $5 billion and $6 billion. Despite Glencore's commitment to gradually phase out thermal coal assets, CEO Gary Nagle anticipates sustained demand for both thermal and coking coal in the foreseeable future.

Coking coal has become a strategic focal point for industry players; and while thermal coal is being phased out globally, mining investors still recognize the economic benefits of cheap energy, regardless of its source.

Following the transaction, Teck's share price has experienced a decline, drawing criticism from some investors who label it as virtue signalling at the expense of profits. In contrast, Glencore's shares have witnessed an increase since the deal's announcement.

Regardless of one's perspective on this move, it underscores the resilience of the coal market, attracting substantial attention within the industry.

A NEW PLAYER ON THE SCENE: BENJAMIN HILL MINING CORP $BNN

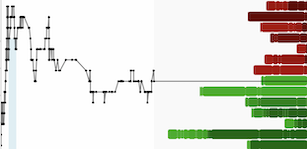

For investors looking to get some exposure to the coal space, the options are quite limited, especially when it comes to small caps. There are however, a few large cap coal companies in the US, all of which are up nearly 100% over the past year. A few examples are NYSE:HCC, NYSE:AMR, NASDAQ:METC, and NYSE:CEIX.

While there are hundreds, even thousands of different natural resource companies on the venture exchange and CSE, there are only a handful of companies that are focused on coal.

One of these companies, Colonial Coal (TSXV:CAD) has already surged over 30% since the Teck-Glencore acquisition news was announced. If Colonial Coal ultimately gets acquired, there will be no coal-focused small cap companies left on the TSX Venture or the CSE, except for one -- Benjamin Hill Mining (CSE:BNN)(OTCQB:BNNHF).

Benjamin Hill Mining is a new player on the scene, having just recently signed an LOI to acquire an interest in a fully permitted coal project in Colombia. With a market cap of just $30 million, the company has huge upside.

A FULLY PERMITTED, HIGHLY PROFITABLE COKING AND THERMAL COAL PROJECT

On November 15th, 2023, Benjamin Hill signed an LOI to acquire a 20% interest in the La Estrella Coal Project and plans to acquire the remainder of the project over time.

The property, characterized by eight known seams of metallurgical and thermal coal from both recent and historical diamond drilling programs and surface exposures, is fully permitted under Colombian Law, encompassing environmental licensing, and benefits from an excellent location with established regional coal mining infrastructure.

The best part about the Estrella Project is that it is essentially a turn-key operation. Being production-ready, it will not take long for Benjamin Hill to build a mine at La Estrella. Upon the project being fully financed, full production capacity can be reached in just 19 months.

The La Estrella project also boasts highly favourable economics — carrying an NPV of USD$17M, an IRR of 250%, and payback period of just 15 months. While the NPV may seem low at first glance, this reason why is because it is only being modelled over a 10-year span. In addition, the project can be expanded significantly over time as only about ~5% of the property has been drilled.

While the La Estrella Coal project is likely to be the primary focus for Benjamin Hill Mining in the foreseeable future, it is important to note the company's ownership of the Alotta Gold Property, where drilling activities have recently commenced and are already showing promising signs of porphyry style mineralization.

Visible Mineralization from Hole ALT-23-001 at 17m depth

The drill program at Alotta comes with a relatively low cost, but if proven successful, it holds the potential for substantial returns, akin to a "bet a million to win a billion" scenario. While the coal project ensures a stable cash flow, the Alotta drill program represents a more speculative venture—a proverbial "shot in the dark" for the company, with the promise of significant rewards for investors, if the drill program is successful. In the event that the drill program does not yield the desired results, the company can redirect its focus to its production-ready coal project in Colombia.

THE BOTTOM LINE

Despite the global shift towards sustainability, coal maintains its throne as the dominant source of electricity generation, contributing a substantial 35% globally as of 2022. The coal industry's resilience is exemplified by major transactions like Teck's $8.9 billion deal, emphasizing the enduring appeal of fossil fuels even amid renewable energy advancements.

The emergence of Benjamin Hill Mining introduces a new chapter in the coal sector, offering investors a unique opportunity to navigate a limited field of small-cap coal companies. The company's strategic move to acquire the La Estrella Coal Project in Colombia, a fully permitted and highly profitable venture, underscores the continued economic viability of coal. This turn-key operation, with exceptional scalability potential, positions Benjamin Hill Mining as a noteworthy player, challenging the status quo.

As the world grapples with the delicate balance between energy needs and environmental responsibility, Benjamin Hill Mining's diversified approach, encompassing both coal and mineral exploration, reflects a dynamic response to industry demands. Whether providing stable cash flow through the La Estrella Coal Project or engaging in the speculative venture of the Alotta Gold Property, the company encapsulates the evolving narrative of the coal industry, showcasing adaptability, resilience, and the potential for substantial returns in a rapidly changing energy landscape.