We are only two weeks into the new year and it looks like this could be an incredible year for Uranium.

The commodity itself is holding steady above $50/lb, up 4.7% in the first 11 days. The US Department of Energy purchased 300 thousand pounds of U3O8, kicking off its earlier solicitation to buy 1 million pounds with up to $75 million in contracts for the strategic uranium reserve. Among other major players, Japan ordered the development of new power plants and approved the restart of 17 shut-down reactors, marking a historical pivot of confidence in the sector since the 2011 Fukushima meltdown. Further, China’s nuclear authorities expanded construction capacity to increase their power plant building objectives to 10 new reactors per year.

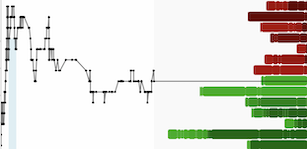

Uranium stocks are looking even more explosive — looking at Haywood’s 63-company Uranium Comps Universe, it is up >15% on average and only three names are in the red YTD. Pretty damn good.

Even Elon Musk is bullish on uranium…

As for me, my top uranium picks for 2023 are still Fission 3.0 (TSXV:FUU) and Strathmore Plus Uranium (TSXV:SUU).

I will put things as bluntly as I can with this next statement: I see 10-bagger potential for both of these plays, and here is why.

Fission 3.0 (TSXV:FUU)

Fission 3.0 remains my top holding going into 2023.

Since the company’s groundbreaking discovery on November 21st of last year, the stock is up +410% and does not look to be stopping anytime soon. At the beginning of 2023, the company announced a 20-hole drill program that commenced at the start of the year which will start to delineate the resource and give us a better understand of how big this deposit really is. I am expecting a flurry of news flow over the course of the next few months, particularly from step-out drilling results. Given the CPS readings and high-grade hits from the last 7-hole drill program, I am confident these next few holes will be similar, if not better than the last few.

This is a highly experienced management team which is also responsible for $FCU’s Triple R discovery, another world-class deposit. This team knows how to finance smartly, and they know how to drill efficiently.

Fission 3.0’s project is located in the heart of the Athabasca Basin, neighbouring both Nexgen Energy’s Arrow deposit as well as ISOEnergy’s Hurricane deposit.

A quick comparison of both Nexgen and ISO during the discovery phase can give us a better idea of how high and fast this thing could run.

When Nexgen made their discovery, the stock ran from $0.30 to $3.00 over a 1-2 year time span. The same thing happened to ISOEnergy's stock when they made their Hurricane discovery, from $0.40 to $4.00 in less than two years. One thing to consider is that uranium investors have learned from the discoveries at Arrow and Hurricane and are now more intelligent, and quicker to react. We know what to look for and it appears that FUU has the goods.

Both of those plays are very similar to FUU, almost identical; however, the initial drilling results and CPS readings (>65,000) at FUU’s Patterson Lake North project are actually even more promising than both Arrow and Hurricane. If FUU manages to hit big on these next few step-out holes, I could see the stock heading towards the $1.00 mark in short order.

One last thing to note about FUU is that it is a very-likely candidate for inclusion into the URA Uranium ETF, which means that URA will need to purchase millions of shares over the next two weeks, this alone could send the stock above $0.50 in the short-term.

Strathmore Plus Uranium (TSXV:SUU)

I am extremely excited about Strathmore Plus going into 2023, for several reasons.

Firstly, the company looks set to begin drilling at its Night Owl project, which has a TON of exploration potential. We know there is uranium in the ground at Night Owl as the property was a past-producing uranium mine, producing 93 tons at a grade of 0.24% U3O8, which was mined at or near surface in the late 1950s to early 1960s. It is important to note that production at Night Owl ceased due to low uranium prices ($7), not for lack of resource. On top of that, the Night Owl area has not been properly explored using modern exploration techniques.

Strathmore has also been scooping up more land in the surrounding area, which is a very positive sign. Management clearly believes in the exploration potential of the project and is trying to accumulate as much land as possible in the area, prior to a major discovery.

Remember that this management team is the same one behind Fission 3.0, so I expect there to be continued spillover from Fission 3.0 over to Strathmore, as traders and investors start to take some profit and come to the realization that SUU may offer just as much, if not more, upside than Fission 3.0.

Despite all the positives listed above, the kicker on Strathmore Plus Uranium, for me, is the share structure. Prior to the recent financing announcement on January 10th, the company had just 33.6M shares outstanding — very tight.

The terms of the financing are for a minimum of $500k and a maximum of $2M, and given how well Dev Randhawa and the rest of the team behind SUU has been doing of late, I would expect them to close on the maximum amount (5M shares). This would mean only 5M shares added to the share count, plus 2.5M warrants at $0.50, and an additional $2M in the bank which should provide ample runway for a full 2023 drill program.

I genuinely see 100-bagger potentially with this play if they can hit big at Night Owl. There will obviously be some dilution on the way, but that will be minimal given the relatively high share price… only 5 million shares issued here is $2M in the bank.

- SmallCapInvestor