The United States faces a pressing issue - it urgently requires more domestic sources of uranium.

As tensions escalate between the US and Russia over the invasion of Ukraine, the likelihood of Western sanctions on Russian uranium are becoming increasingly likely. Such sanctions would greatly impede the US's nuclear power capabilities as nuclear power accounts for 20% of the US's energy generation. Very little is produced domestically. The vast majority of the US's uranium is currently imported from Russia, Kazakhstan, and Uzbekistan.

Despite being one of the largest consumers of uranium globally, there are limited production capabilities for the US as the break-even point for many US-based uranium mines stands at $60 per lb, while uranium prices are currently around $51 per lb. If these sanctions do occur, it will put immense upward pressure on uranium prices as the US scrambles to find new domestic sources of uranium.

STRATHMORE PLUS URANIUM (TSXV:SUU) HAS THE POTENTIAL TO PROVIDE A NEW DOMESTIC SOURCE OF URANIUM FOR THE U.S.

I started writing about Strathmore Plus (TSXV:SUU) a few months ago when it was trading around $0.35. I highlighted the company’s assets, management team, and most importantly the share structure. It ticked all of my boxes so I took a starter position at $0.35 and have been adding to it on the dips. Since then, the stock has seen a lot of volatility, peaking around $0.70 but recently retracing to the $0.45 range where it has been consolidating nicely. This stock is a fun one to trade as it moves quickly due to the tiny float (35M shares) and market cap of just $16 million, but more importantly, it stands out with its long term potential as an early-stage uranium play. There was a recent release of private placement stock on February 28th which has been putting downward pressure on the stock BUT most of that paper looks to have been chewed through, signaling that the stock is ready to resume its upward trend.

Despite being an early-stage exploration company, Strathmore Plus Uranium has multiple highly sought-after properties with HUGE potential, one of which has a history of past uranium production AT SURFACE and another which is directly adjacent to Cameco. Best of all, this company has a highly experienced management team with a history of previous discoveries and a VERY tight float to go along with it.

Strathmore Plus Uranium has three highly prospective projects in Wyoming: Night Owl, Beaver Rim, and Agate.

The Night Owl Project

Night Owl is, in my opinion, the most highly prospective of the company’s three assets. The Night Owl project is located in the Shirley Basin of Wyoming — an area with a long history of uranium mining and exploration. Other uranium companies in the basin include Cameco, enCore Energy, UR Energy, and UEC.

Not only is the project located in the heart of the U.S., but Night Owl was actually a past-producing uranium mine in the early 1960s, producing 93 tons at a grade of 0.24% U3O8, which was mined at or near surface. Uranium mining operations at Night Owl ceased not due to a lack of resources, but due to the low uranium prices, which were around $7. Since then, the Night Owl area has not been properly explored using modern exploration techniques but Strathmore Plus has plans to change that.

Rather than jumping the gun with an aggressive exploration campaign, the company has first decided to assemble the largest possible land package prior to turning on the drills. In December of 2022, they increased the size of Night Owl by 300%, adding a 640-acre mineral lease and staking 54 new claims in the area. This just goes to show how much this management team believes in the exploration potential of this land package. Strathmore plans to complete the geophysical survey in the upcoming year and start exploring the new parcels to increase the extent of uranium mineralization at the project.

Mr. Terrence Osier, PG, Vice President of Exploration for Strathmore commented, "We acquired the additional adjacent claims because they cover the same geologic formations and results of the geophysical survey indicate many additional and impressive areas of radiometric anomalies similar to the Night Owl mine site."

THE AGATE PROJECT

The Agate project is also located in the Shirley Basin. Agate is an in-situ recovery (ISR) project, which is a low-cost method of extracting uranium that involves pumping a solution into the ground to dissolve the uranium, and then pumping the uranium-rich solution to the surface for processing.

Strathmore Plus recently announced they are planning a 100-hole drill program for a total of 15,000 feet at Agate this summer once the drilling permit is approved. In conjunction with the drilling, Strathmore will conduct near-surface and downhole geophysical research by teaming up with the University of Wyoming to digitize historical drill data and vector in on new drilling targets. This partnership between Strathmore Plus and the University of Wyoming should allow the company to save both time and money in doing so - a great partnership.

The Beaver Rim Project

The Beaver Rim project lies immediately south of the main Gas Hills District, which is widely considered to be one of the most important uranium districts in the United States. Uranium in the Gas Hills area is generally considered to be of high grade and relatively low cost to extract. Much of the surface area near Gas Hills was extensively mined for uranium from the 1950s to the early 1980s, after which most of the mines in the area were put on care and maintenance due to low uranium prices. With uranium prices hovering around $50/lb, the area is starting to heat up again.

The biggest player in the Gas Hills area is CAMECO— one of the largest uranium companies in the world with a market cap of $15.5 billion.

Strathmore Plus’s Beaver Rim project is DIRECTLY ADJACENT to Cameco's Gas Hills-Peach Uranium Project. Cameco’s property in the region boasts M&I resources of 13.3mm lbs of uranium and another 6mm lbs in the inferred category. Given the close proximity of the Beaver Rim property to Cameco, there is a chance that this resource may also spill over onto Strathmore Plus’s property.

Previous exploration on Beaver Rim, including as recently as 2012 by Strathmore Minerals Corp., discovered MULTIPLE ZONES of uranium mineralization on several of the claims acquired under this purchase agreement. Historical and recent reports suggest 50-100 million pounds of uranium resources remain in the Gas Hills, with significant discovery potential in the less explored areas to the south, right in the Beaver Rim area where Strathmore Plus is located.

PRIVATE PLACEMENT HOLD PERIODS

While fundamentals as well as the quality of a company’s assets are always important, what really tends to drive the price of a junior mining stock is the motives of buyers and sellers. Meaning, who is holding the paper? what price are they holding at?

Regardless of fundamentals, when people see a win, they tend to take some profit off of the table, especially guys who do private placements. This is even more true when there is a warrant attached to a PP unit - as guys will tend to sell the share if its trading above the PP price and simply keep the warrant, which essentially gives them a free ride on the stock. For this reason, I always like to keep track of any recent private placements as well as hold period expiration dates on a to get a rough estimate of when sellers might be done selling.

With some quick napkin math, we can give ourselves an approximate deadline for when the last round of private placement stock may be chewed through.

On October 28th of last year, Strathmore Plus closed a $1.35 million private placement financing at $0.33 with a full warrant at $0.40. Anyone who participated in this financing would be forced to escrow their shares for a period of 4 months. This is a standard hold period for any financing. After those 4 months are over, those shares are unlocked and they can sell freely.

The private placement equated to to 4.12 million shares being issued and another 4.12 million warrants — a total of 8.2M shares and warrants in total. It is important to note that 1.2M of those shares and 1.2M warrants were issued to insiders. Subtracting the insider participation shares and warrants from the total shares issued leaves about 5.8M shares and warrants that could have been sold after the escrow release date — this is the amount of volume we would like to see before we can safely assume that most of the paper has been flushed out. So, if we take the total volume since the release date, plus a few days to account for people shorting prior to that, then we can give ourselves a rough idea of how much more volume we will need to see before the paper is flushed.

Now you might be thinking that there is a lot of volume from day-traders that isn’t factored in to these calculations but this is counter-balanced by the fact that I assumed 100% of all non-management paper would sell, when in reality there is a good chunk of the investors who did the placement which do not plan to sell just yet.

Keep in mind this is a rough picture, as it makes many assumptions about people buying and selling.

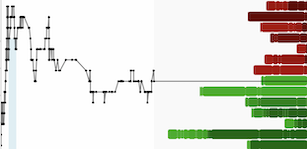

We can see that since the release date, about 6 million shares have traded. So, we can assume that a majority of the paper from the private placement has already been flushed, which leaves a nice runway for the stock to resume its upward trend — and we can see over the last few trading days it has started to do exactly that.

A BULLISH TECHNICAL SET UP

I’m not a huge proponent of technical analysis but I do like to look at a chart set up and a few technical indicators before entering or exiting any position.

As for Strathmore Plus, the stock has been in an uptrend since the start of 2023 and that trend has not broken down. For now, the stock seems to be consolidating in a channel between $0.40 and $0.60, hovering just above the 200 day moving-average.

I am seeing a few key resistance levels, the first at $0.60, and the next at $0.70 — beyond that there is no resistance left in the chart.

As for support, there is a primary support at $0.45, which the stock has bounced off a couple times very recently, and a secondary support level at $0.40. I see both of these prices as good levels to enter.

THE BOTTOM LINE

It is still very early days for Strathmore Plus Uranium. The company ticks all the right boxes for investors in terms of asset quality, management team, and share structure and with such a low float and market cap of only $16 million, it provides a huge opportunity for both short-term traders and long-term uranium investors to capitalize on the inevitable rise in uranium prices. It will not take much to move the needle here, especially once the remainder of the loose paper from the last financing round is chewed through. Once that happens, I expect the stock to resume its upwards trend.