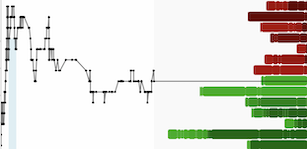

Bitcoin had been undergoing a correction for the past week after hitting an all-time high on March 14. Last Wednesday, it dropped to as low as around $60,800. However, despite these setbacks, Bitcoin seems poised to finish March on a positive note.

In the span of 24 hours, Bitcoin price surged by 7% to nearly $71,000. This brought the leading digital asset up by almost 20% from its low of under $61,000 on Wednesday, but it still remained about 4% below its record of $73,768 set on March 14.

Crypto traders were feeling optimistic about returning to the risk asset as the sentiment for bargain-hunting made a strong comeback at the beginning of the trading week. The valuation of BTC reached approximately $1.4 trillion.

Most other cryptocurrencies followed the upward trend of Bitcoin, with ETHUSD, for instance, experiencing a 6.5% increase. MicroStrategy, which is seen as a proxy for the price of Bitcoin, surged by 29%, while Coinbase advanced by 17%.

Digital assets are gearing up to conclude a significant quarter, with Bitcoin reaching a new all-time high of $73,000 earlier this month. Additionally, the Securities and Exchange Commission – the top regulatory authority on Wall Street – approved 11 spot Bitcoin exchange-traded funds (ETFs), signaling a potential shift in the investment landscape.

Looking ahead, April is expected to be another significant month for the original cryptocurrency. Digital asset communities worldwide are preparing for the upcoming Bitcoin halving event, which will halve the incentive to mine BTC. Volatility could increase well before the anticipated halving date on April 19.

Bitcoin bulls, including institutional investors, believe that Bitcoin still has room to grow. Analysts at Standard Chartered and Bernstein have year-end price targets of $150,000 and $90,000, respectively. However, historical precedent for a publicly traded asset following a sharp increase in its price suggests that there may be some challenges.